Currently, the entire world is embroiled in a war, from the Asian continent to the Middle East. The Russia-Ukraine war rang alarm bells for a prolonged war situation, followed by Hamas attacks, which have led to the current conflict involving Israel, Hamas (Gaza), Lebanon, and Iran. With the Houthis attacking the Red Sea, major uncertainty in supply chains has clouded the global trade scenario, at least in the short term. In the past, geopolitics did not play a major role in how trade between countries was mapped out, but with recent geopolitically influenced policies and wars, trade is bound to be affected. Additionally, the demand for discretionary products will fluctuate against a background of inflation due to supply chain shocks, resulting in a shortage of goods and a rise in prices within the country.

Impact of geopolitical policies on global trade

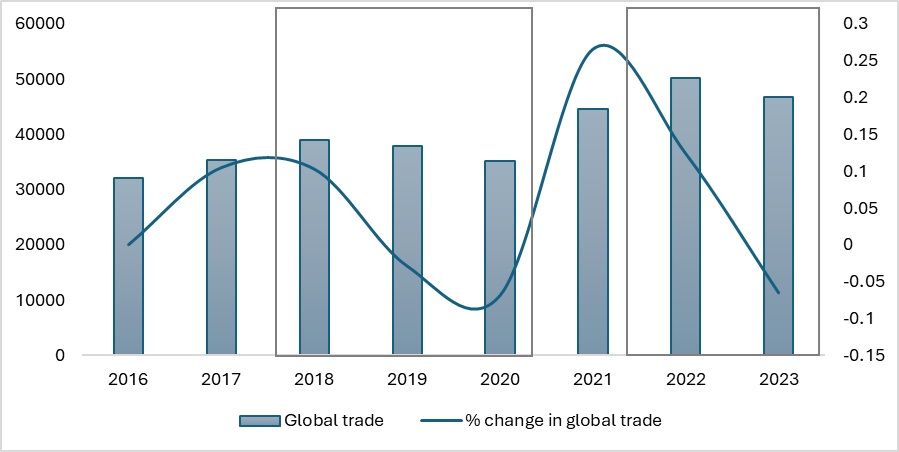

The first impact on global trade was due to the trade war waged between China and the US by the Donald Trump administration. This trade war, which involved two major economic powers, resulted in trade being impacted for two years. Global trade fell by 3 per cent in 2019 and further by 7 per cent in 2020, when not only the trade war was in play but also the COVID-19 pandemic, which shut down supply chains, impacting transportation routes and introducing stricter norms for goods entering countries. The US-China trade war resulted in a significant reduction in Chinese imports to the US, although the trade war led to some countries partially benefiting due to substitution and complementary effects.

Exhibit 1: Global trade (in $ bn)

Source: ITC Trade Map, F2F Analysis

Although the US-China trade war had some positive effects for nations like Mexico, Vietnam, and Korea, other major countries, such as Israel and Ukraine, among many, suffered a reduction in exports to the US. Apart from this, both the US and China also suffered from the trade war, resulting in a significant loss as a percentage of their total GDP. This was followed by the COVID-19 pandemic, during which all nations worldwide suffered major losses in trade due to the policy measures undertaken by these nations, with underdeveloped nations being the most affected. The textile trade, among many others, was the hardest hit during this period.

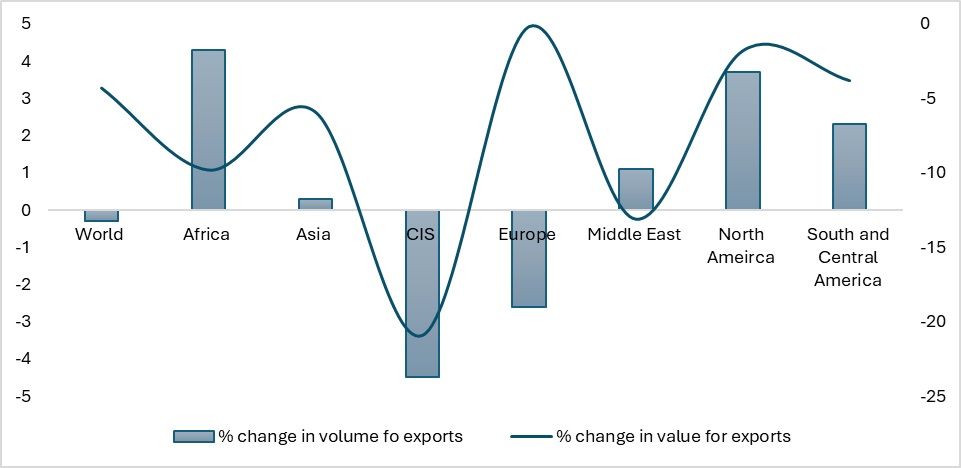

After the pandemic, the most important phase began in 2022 and 2023, where geopolitical issues came to the forefront. Since then, nearly all countries are working on protecting their local industries and securing their supply chains, as many fear indirect retaliation in one way or another, which could significantly impact their trade. In 2023, exports in terms of volume from the CIS region, which includes all the former Soviet states, declined the most due to sanctions on Russian exports. On the other hand, exports from Africa, the US, and Central and South America followed.

Exhibit 2: Region -wise growth in the volume region-wise in 2023

Source: World Bank

When analysed in terms of value, Europe saw the highest rise, followed by North America, whereas Asia and Africa saw a modest rise. The increase in the value of EU exports can be attributed to a weaker EU currency, which boosted the bloc’s exports to countries like the US and China, the largest export destinations for the EU. In contrast, for Asia as well, the value is higher due to a weaker currency. The only region that suffered both in terms of value and volume was the Middle East, which was impacted by the war in the region, leading to dampened demand for oil. Additionally, the Chinese economy, one of the top consumers of oil, experienced a slowdown.

Apart from this, Asian economies also saw disruptions in goods transportation due to attacks in the Red Sea, affecting shipments from Asian countries to key destinations like the EU and the US. With rising container rates, many Asian textile economies had to hold on to their stock, resulting in a loss of orders from consumer countries. This trend also gave rise to nearshoring, where countries sourced/imported commodities from geographically closer nations to save costs and reduce the risk of shipment delays due to potential geopolitical issues. For example, the US is already considering Mexico as an ideal destination for nearshoring in various sectors, with the textile and clothing industry seeing the largest growth from 2023 to 2024.

In addition to geopolitical reasons, shipping costs have reduced drastically. Furthermore, countries have implemented restrictive policies to limit imports from certain nations. With rising geopolitical tensions, countries globally are also adopting policies to protect their domestic markets and ensure that supplies are secured in light of increasing geopolitical challenges.

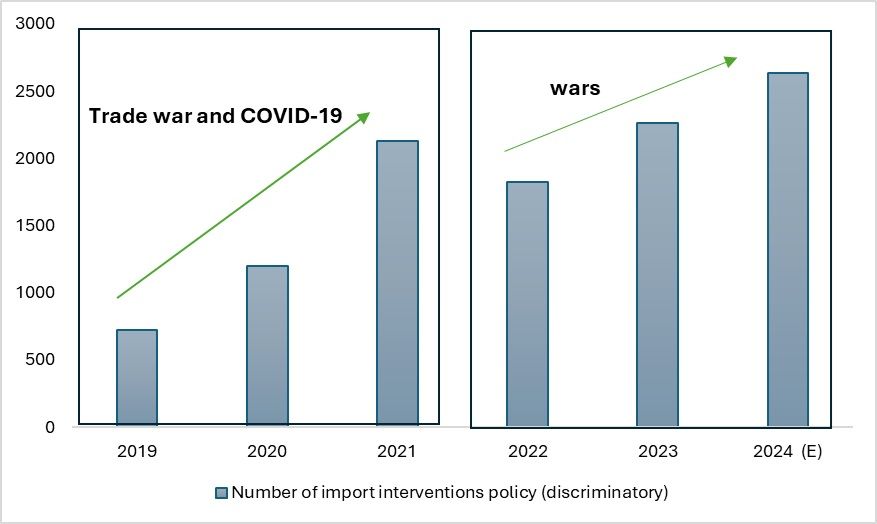

Exhibit 3: Discriminatory import intervention policies (in numbers)

Source: Global Trade Alert

With increasing geopolitical tensions, countries have started imposing more import restrictions. Such discriminatory policies peaked during the trade war between the US and China. Today, China is the most affected country, followed by India, the US, and Australia. Although the interventions reduced dramatically with the pandemic, they began to rise again after the onset of wars in Russia and the Middle East. With increasing geopolitical tensions, the number of sanctions has also risen globally.

Many restrictions on textile products impact Asian nations the most. In 2023, there were 108 import-related restrictions imposed on textile yarn and natural thread, 104 on textile fibres, 106 on man-made staple fibres, and 137 on wearing apparel. In all these import restrictions, Asian countries are both contributors and the most affected. Nations like China and India are the worst affected by import restrictions in the above-mentioned categories. The textile industry has also been adversely impacted. The increase in geopolitical conflicts, along with the resulting sanctions and rising protectionist tendencies, has significantly reduced textile trade.

Geopolitics and resilience

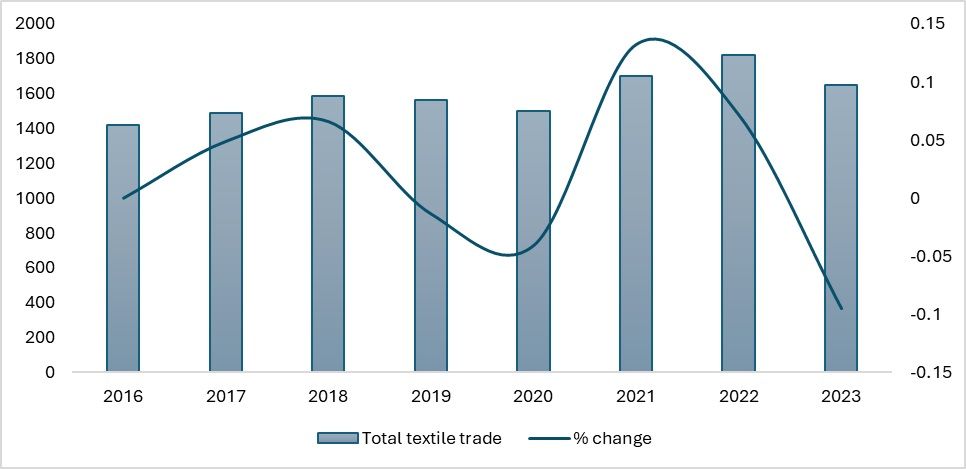

In the wake of recent wars and the restrictive policies applied by many countries regarding what they can import in textile products, the textile trade has been significantly affected. In 2023, with the increase in sanctions on countries like Russia, Israel, and China, the textile trade reduced by around 10 per cent. As the number of import restrictions rises, the textile trade of affected countries falls significantly. There is a strong negative correlation between the trade restrictions imposed and the level of textile trade.

Exhibit 4: Change in Global textile exports (in $ bn)

Source: ITC Trade Map, F2F Analysis

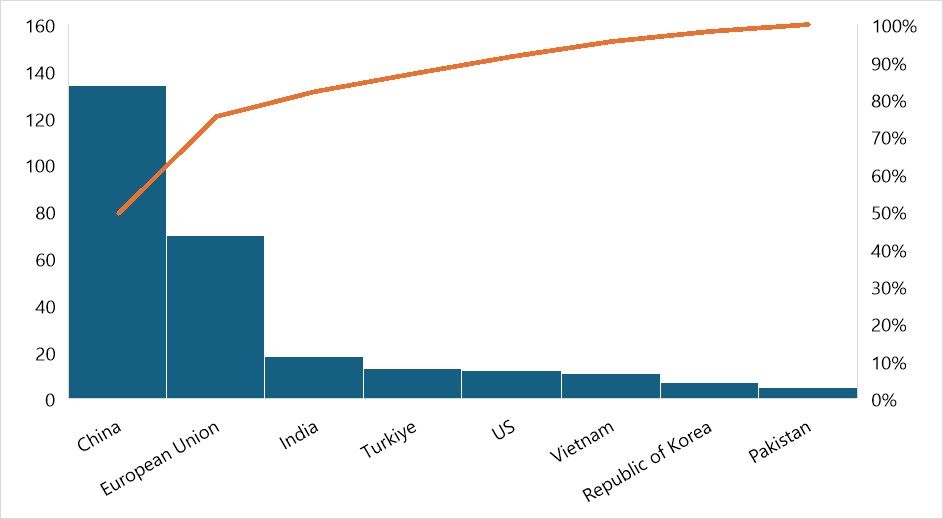

Over the years, there has been a 16 per cent increase in overall discriminatory import policies and a 10 per cent increase in discriminatory import policies for apparel. This has led to an overall fall in textile trade. However, even though import policies are currently among the most disruptive trade policies, affecting China the most, China remains the top exporter of textiles and apparel, as reported by the World Bank. At $134 billion, it continues to be the leading textile exporter globally. The primary reason is that major textile-manufacturing countries import yarns, fabrics, and fibres from China. From Cambodia to Bangladesh, countries like Vietnam, Indonesia, and India import more than 50 per cent of these materials from China.

Exhibit 5: Top textile exporters in 2023 (in $ bn)

Source: World Bank

The proportions may change as investments flow into countries like Vietnam, Indonesia, and Cambodia to make their textile industries more vertically integrated, enabling them to become more self-reliant and less dependent on China. According to a report released by the US Fashion Industry Association in 2024, all Asian countries need to achieve vertical integration in their textile industries, as they all face varying degrees of risk from geopolitical tensions due to skirmishes between China and the above-mentioned nations. However, the report highlighted one important factor: Asian countries are far more competitive than other nations, particularly in their ability to quickly adjust orders.

In Asia, the Southeast Asian region has received the highest FDI among geopolitical regions, as it is considered safer compared to others. Singapore and Vietnam were the largest recipients of FDI. In South Asia, India’s investments declined, although the country remains one of the top FDI recipients in the region.

Can India have the upper hand in this situation?

Even though India's capacity remains highly insufficient to meet global demand, there is still much that can be done. Currently, India is the only South Asian nation with a highly vertically integrated industry, which is a plus point for the country. However, labour compliance and environmental compliance remain major issues.

In terms of geoeconomics, India is well-positioned due to its easy connectivity to seaports and good infrastructure, which promote better and cost-efficient exports. The country is also a major exporter to the EU and the United States. However, the speed at which India’s products reach their destinations depends on the management of key routes, such as the Red Sea, which accounts for over 50 per cent of India’s trade.

Additionally, with India already emphasising economic and trade issues through forums like the G20 and other multilateral meetings, the country could eventually emerge as a trustworthy destination for FDIs, similar to Vietnam and Singapore. However, India is affected by import interventions implemented by various countries globally. In the textile sector, India is impacted in areas that are among its key export sectors.

Exhibit 6: Number of discriminatory import interventions affecting India

Source: Global Trade Alert

Summing up

In an era of increasing protectionism, where countries are seeking to secure their supply chains and protect their domestic markets simultaneously, there is a rise in import restrictions. These restrictions often come in the form of import quotas, quality restrictions, and higher import tariffs. A prime example of this trend is the current US elections, where Donald Trump is suggesting a blanket tariff of 20 per cent on all imported goods, or India, for that matter, which applies a Quality Control Order (QCO) on the imports of man-made fibre and other textile materials.

With the rise in wars and global tensions, many countries prefer nearshoring or friendshoring. The US, for example, increasingly favours Mexico as a manufacturing and sourcing hub, especially for commodities like apparel. Similarly, the EU is considering Turkiye as an option for nearshoring due to its close geographical proximity, bringing geo-economic factors into play.

The current crisis in the Middle East, potentially escalating into a prolonged conflict, China’s ongoing skirmishes with nations in East and South Asia, and the Russia-Ukraine war have all led to numerous sanctions, impacting many countries' capacity to trade openly. Additionally, there is an ongoing risk of potential trade conflicts between India and Canada, the EU and China, and uncertainty in trade between India and Bangladesh. As a result, many countries are now attempting to frame new Free Trade Agreements (FTAs) or extend existing agreements across various sectors.

This trend is also affecting the textile trade. The largest consumers of textiles and apparel – the US, EU, and Australia – may start seeking trade partners that are geographically closer or, at the very least, more geopolitically stable. The US is looking at Mexico and the CAFTA-DR nations, while the EU is considering local manufacturing and pursuing FTAs with countries like India to secure its imports. This has made it imperative to not only impose retaliatory tariffs but also to sign agreements that liberalise trade between partner nations. However, the trade agreements intended to increase market access remain in very preliminary stages, and the existing agreements are often ineffective. Consequently, global textile trade has shrunk by 10 per cent, reflecting the failure of current policies to enhance market access sufficiently to counteract the impact of geopolitical tensions, retaliatory tariffs, trade conflicts, and other trade barriers.

Fibre2Fashion News Desk (KL)