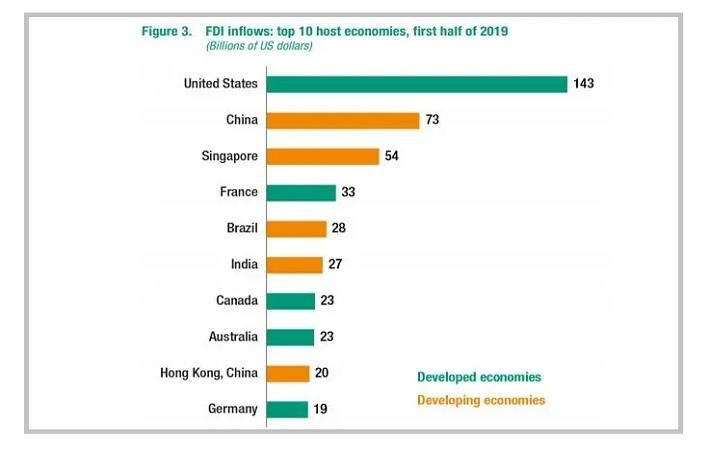

Despite trade tensions, foreign direct investment (FDI) in China rose by 4 per cent in 2019 first half to reach $73 billion, according to a United Nations Conference on Trade and Development (UNCTAD) report, which said India was the main driver—with an FDI rise of over 20 per cent to $27 billion—in South Asia, where FDI rose by 14 per cent to $32 billion in the period.

Global FDI flows in 2019 first half were worth $640 billion, 24 per cent higher than the ‘anomalously low level’ of $517 billion in the same period in 2018, said the UNCTAD’s latest Global Investment Trend Monitor. In the first half of 2018, US tax reforms started a wave of repatriations of overseas retained earnings by US multinationals.

However, the value of global FDI flows in the first half of 2019 represented a decline compared to the second half of 2018, and remained below the average level of the past ten years.

In the first half of 2019, FDI flows to developed economies reached $269 billion, almost doubling from the first half of last year, while inflows to developing economies remained relatively stable at an estimated value of $342 billion, said the report.

China remained the second largest FDI host globally after the United States, which received FDI inflows worth $143 billion during the period.

UNCTAD said prospects for the full year's FDI flows remain in line with earlier projections of a 5-10 per cent increase. The rebound of flows in developed economies is likely to hold. Developing countries are expected to remain stable, with growth centring on Southeast Asia.Southeast Asia remains the region’s growth engine; FDI rose to $93 billion, a 29 per cent increase from 2018 H1. The growth was driven by several economies, including Indonesia, Malaysia, Singapore and Vietnam, with significant new inflows into manufacturing sectors.

However, weaker global economic activities and ongoing trade tensions form the greatest risk to FDI growth, warned the UN organisation.

Fibre2Fashion News Desk (DS)