Olympic athletes and teams prioritise comfort and flexibility while also focusing on style and fashion through their choice of athleisure and sportswear. Leading brands and nations are showcasing sportswear that exemplifies flexibility, durability, and stretchability. Sportswear garments are specifically designed for physical activities, exercise, or athletic performance and are crafted from materials that provide comfort, flexibility, and moisture-wicking properties to support physical exertion. These garments often feature breathable fabrics and enhanced durability to improve performance and ease of movement.

India's involvement in the sportswear industry has been relatively modest, primarily due to limitations in producing man-made fibres (MMF) and synthetic fibres essential for sportswear. However, with India's ongoing initiatives, including the Production Linked Incentive (PLI) scheme, increased budget allocations for technical textiles, and reductions in basic customs duties on critical chemicals, the country is well-positioned to emerge as a significant player in the sportswear export market.

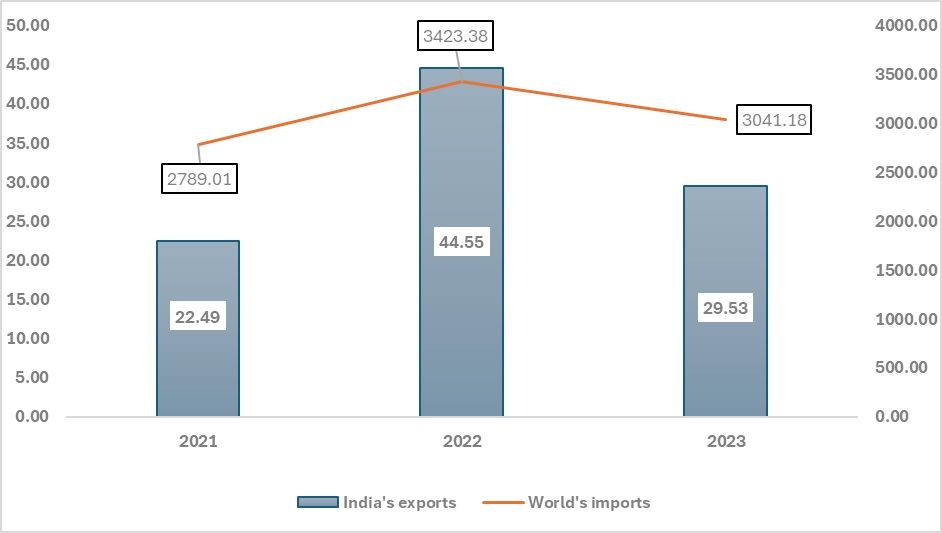

Figure 1: World’s imports and India’s exports in sportswear (in $ mn)

Source: TexPro, F2F Analysis

The figure above illustrates the total global import value of sportswear in millions of dollars, along with India's contribution to this total. India's contribution accounts for a mere 1 per cent of global sportswear imports. For the calendar year 2023, India's sportswear exports amounted to $29.53 million, following a similar trend to global imports over the years. Global sportswear imports totalled $3,041.18 million, reflecting a sharp 33 per cent decrease compared to CY2022. The year 2022 saw a resurgence in sporting events worldwide following the COVID-19 pandemic, which had significantly reduced sports activities to indoor settings.

The increase in sportswear imports during 2022 could be attributed to the resumption of outdoor sports activities. In CY2023, sportswear imports have returned to more typical levels, showing a 9 per cent increase compared to CY2021. For India, the swimwear category for women and girls ranks highest in terms of export value. Currently, India's sportswear exports stand at $11 million for CY2024 (January-May), down from $13 million exported in the first five months of CY2023 (January-May) . India must address these challenges by analysing current market trends and enhancing manufacturing capabilities, particularly in intermediaries such as polyester and synthetic yarn.

India’s performance in the global market

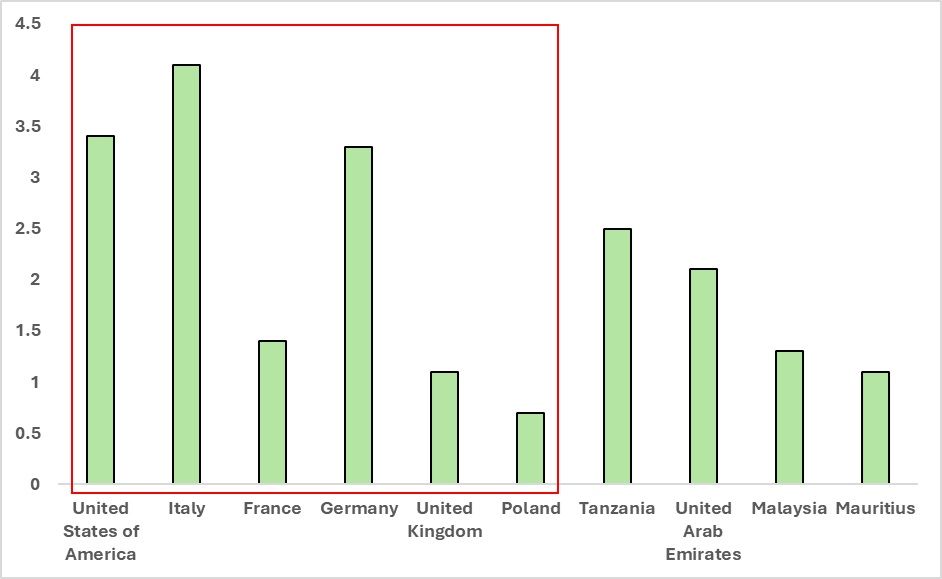

Figure 2: India’s top 10 destinations for sportswear exports (in $ mn)

Source: TexPro, F2F Analysis

India has managed to establish its prominence in only a few of the top 10 world destinations for sportswear imports. India’s top importing partner is Italy, which happens to be the second-largest importer globally, just after the US. Italy accounts for a significant portion of India's exports, with 13.9 per cent ($4.1 million) of India's sportswear apparel being exported to the European nation. The US and Germany rank second ($3.4 million) and third ($3.3 million), respectively, among India's major sportswear importers.

It is important to note that only six of the top importing countries globally feature in India’s list of top sportswear apparel importing countries. These top six countries are the US, Italy, France, Germany, the UK and Poland. Although the US ranks highest globally, India has a stronger presence in Italy compared to the US. India also has a limited presence in three major European markets, France, United Kingdom and Poland, which are known as some of the largest sportswear apparel importers on a global scale. Similarly, India has a very negligible presence in other top European importing countries such as Spain, the Netherlands, and Belgium. Instead, India has redirected its sportswear trade to nations in the Southeast Asia region, such as Malaysia and Mauritius, as well as to countries where it has a free trade agreement (FTAs) or sees potential for future trade agreements, such as the UAE and United Republic of Tanzania.

India’s trade in sportswear apparel and the Revealed Comparative Advantage (RCA)

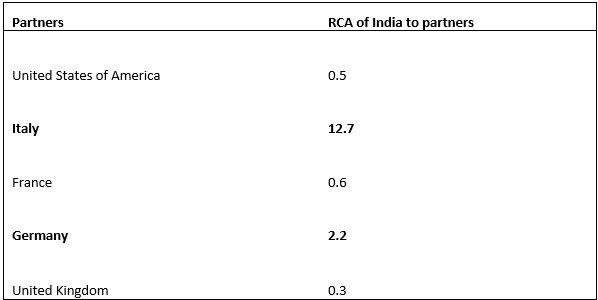

Figure 3: India’s RCA for sportswear apparel with top 5 importing countries

Source: TexPro, F2F Analysis

India’s RCA for sportswear apparel indicates a nuanced competitive position across its top importing countries. The RCA values reflect varying levels of competitive strength in the sportswear sector. For instance, Italy, with an RCA of 12.7, demonstrates a significant comparative advantage, suggesting that India is relatively strong in exporting sportswear to Italy compared to other nations. Germany also shows a notable RCA of 2.2, indicating a moderate competitive advantage in this market.

In contrast, India’s RCA is considerably lower for the US (0.5), France (0.6), and the UK (0.3), indicating weaker comparative advantages in these countries. This disparity highlights that while India has a solid foothold in certain European markets like Italy and Germany, its position in key markets such as the US and the UK is less pronounced. These insights suggest that India’s sportswear apparel exports are more competitive in specific European regions, and there may be opportunities for strategic adjustments to enhance competitiveness in markets with lower RCA values.

India’s policy implications on sportswear exports

India recently released its Budget for 2024-2025, which includes several policy changes affecting the textile industry, particularly concerning customs duties on intermediate products used in the production of finished garments and apparel. One significant change is the proposed reduction in the Basic Customs Duty (BCD) on Methylene Diphenyl Diisocyanate (MDI), an intermediate chemical used in the production of spandex yarn, from 7.5 per cent to 5 per cent. This reduction is expected to boost domestic manufacturing of spandex yarn in India, a crucial intermediate good in the production of stretchable and compression-based sportswear apparel.

Lowering the customs duty on MDI will reduce the cost of spandex yarn production, thereby increasing the availability and competitiveness of sportswear. This, in turn, is expected to enhance India's ability to export more sportswear to key markets, strengthening its presence in high-value international markets.

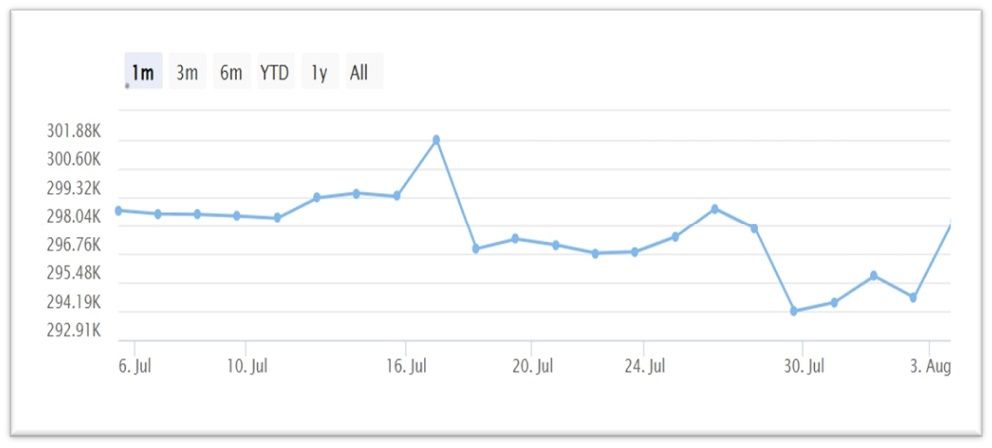

Figure 4: China’s pricing for July-August 2024 (in ₹/MT terms)

Source: TexPro, F2F Analysis

China is the leading exporter of spandex yarn, benefitting from its low-cost bulk manufacturing capabilities. However, India has been experiencing daily price increases, with current prices for August at ₹350 (~$4.16) per metric tonne (as of August 6, 2024). The Caixin/S&P Global Manufacturing PMI fell to 49.8 in July from 51.8 the previous month, marking the lowest reading since October last year and missing analysts' forecasts of 51.5. Prices are expected to rise further given the current conditions and the weakening of China’s manufacturing capabilities due to low demand and adverse weather conditions in some regions.

With rising spandex yarn prices and a dip in China's manufacturing abilities, India has an opportunity to enhance its manufacturing capabilities, particularly in spandex yarn, supported by the government's reduction of basic customs duties. This situation is likely to boost India's sportswear exports.

Way Forward

India's strength lies in its robust trade relations with European countries, a central hub for consumers seeking quality apparel, especially sportswear. According to F2F analysis, Italy and Germany are key markets for India to focus on for sportswear exports. Italy is home to many high-quality apparel and garment brands. Additionally, an Ipsos survey conducted with the World Economic Forum found that Germany ranks second, following the Netherlands in first place, in terms of the highest number of citizens engaged in sports activities. These factors provide strong incentives to boost exports to these two advantageous countries.

India should concentrate on producing sportswear that complies with REACH standards and EU labelling requirements, particularly for key markets such as Italy and Germany. The European Union has recently updated regulations concerning children’s apparel, including children’s sportswear, which presents an opportunity for India to export high-quality and innovative sportswear to Italy, Germany, and other potential EU markets such as Spain, the Netherlands, and Belgium.

Sportswear production predominantly relies on man-made and synthetic fibres, which are receiving increased attention in the Indian textile industry due to the limited production capacity of cotton. To support this, the government is implementing the Production Linked Incentive (PLI) Scheme for textiles, with an approved outlay of ₹10,683 crore (~$1.27 billion), aimed at promoting the production of MMF apparel, MMF fabrics, and technical textiles. This scheme seeks to scale up the textile sector and enhance its competitiveness. Seventy-three companies have been selected under the PLI scheme, which is expected to benefit downstream manufacturers of sportswear in the long term.

Fibre2Fashion News Desk (NS)