The Indian baby wear (0-24 months) sector accounted for approximately 8 per cent of the country's total textile exports in the calendar year 2023. This is higher compared to leading textile-exporting countries such as China, Bangladesh, and Vietnam, where baby wear exports constitute around 1-3 per cent of their total textile exports. India's focus on this sector can be attributed to its status as one of the major producers of cotton, a material favoured in baby wear production for its natural qualities such as high absorbency, softness, and breathability.

The Union Budget of India for 2023 emphasised the production of Extra Long Staple cotton, which is extensively used in producing baby wear. Several factors are poised to significantly enhance the export potential of cotton and related apparel, particularly in segments like baby wear. Expanding this market is crucial due to the increasing demand from major importing countries for Indian baby wear products. Additionally, the active participation of numerous export stakeholders in this sub-sector underscores its significant growth potential.

Figure 1: India's share of textile sub-categories by product type (in %)

Source: TexPro

India ranks third in the global baby wear market, following China and Bangladesh, which hold the first and second positions, respectively. In the calendar year 2023, India exported $1.08 billion worth of baby wear worldwide, while China, the largest baby wear exporter, exported $2.05 billion. According to the National Health Mission, India has a substantial domestic market due to its high baby population, estimated at approximately 26 million children are born every year.

India's baby wear market is well-established in developed nations, but further research could help identify additional regions of interest within these areas. Additionally, India has the potential to expand its market in Africa, which has a high fertility rate and a growing baby population.

Despite China's strong position in the baby wear sector, India has been performing exceptionally well, with a growth rate of 6 per cent in the calendar year 2022. In contrast, China's growth rate declined by 1 per cent in the same year for HSN code 6111 (babies' garments and clothing accessories, knitted or crocheted).

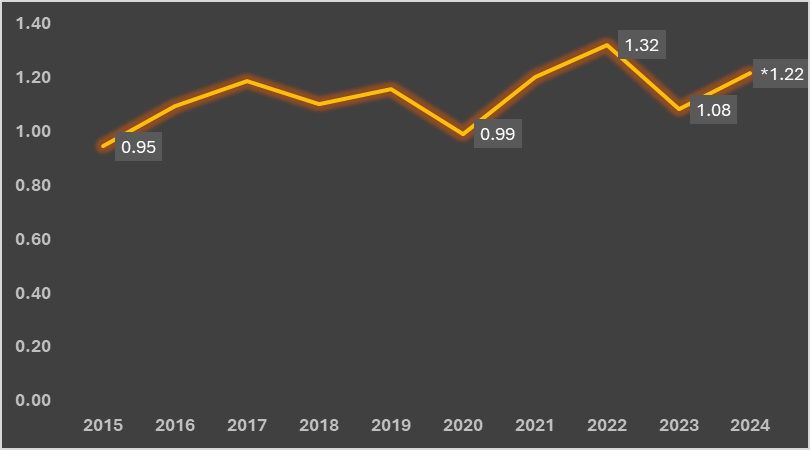

Figure 2: India’s total baby wear exports over the past decade (in $ bn)

Source: TexPro, author’s calculations

*Indicates estimated value for calendar year 2024

The above graph illustrates the growth of India's baby wear exports over the past decade. India's exports in 2015 were at $950 million ($0.95 billion). From 2015 to 2017, there was consistent growth, followed by a slight dip in 2018 and a significant decrease in 2020. The decline in 2018 can be attributed to the limited export incentives provided to the sector. The notable decrease in 2020 was primarily due to the COVID-19 pandemic, which significantly disrupted supply chains and international trade. In the calendar year 2023, baby wear exports stood at $1.08 billion, experiencing a decrease from $1.32 billion in 2022. This decrease can be attributed to the declining fertility rates in major developed countries, which are India's largest importers of baby wear.

The value for baby wear exports in 2024 is predicted to be $1.22 billion. This forecast is a positive sign for the baby wear industry and can be attributed to the overall growth in India's apparel sector and the implementation of schemes such as PM Mega Integrated Textile Region and Apparel (PM MITRA), which aims to establish integrated parks with a special focus on the apparel sector. An optimistic outlook, combined with government initiatives, is expected to incentivise baby wear apparel exporters.

India’s major importers and potential markets

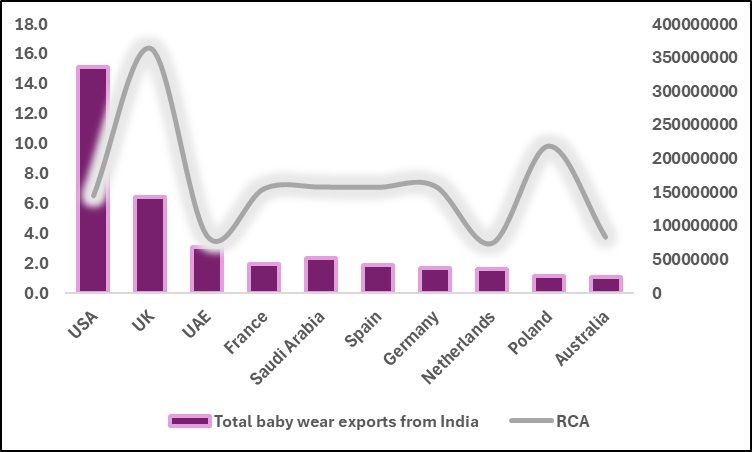

Figure 3: Top countries importing baby wear from India

Source: TexPro

India's baby wear clothing industry has established a significant presence in key markets across the globe, including the US, the UK, the UAE, Saudi Arabia, and several European countries such as France, Spain, Germany, the Netherlands, and Poland, along with India's Indo-Pacific partner, Australia.

In 2024 (January-March), India's exports to the US totalled $90.21 million, showcasing a noticeable increase from the previous year's figure of approximately $67.02 million, representing robust growth of 34.6 per cent. This positive trajectory is not unique to the US; similar trends have been observed across top importers such as the UAE, France, and Spain. The UK imported baby wear worth $48.30 million between January 2023 and March 2023, which is lower compared to $49.59 million in the current year for the same months. Exports to these destinations have exceeded the values recorded in the same period of 2023 (Jan-Mar), reflecting a consistent and promising expansion in the global market for Indian baby wear products.

Analysis of India’s major importers and emerging markets

Figure 4: India’s babywear exports (in $ mn) and bilateral RCA

Source: TexPro, United Nations Comtrade, author’s calculations

The above figure represents both India’s apparel exports to top importer countries along with individual RCAs. If a country's Revealed Comparative Advantage (RCA) for a particular product is greater than 1, it indicates that the country specialises in and has a comparative advantage in manufacturing that product compared to the rest of the world. The results show that India has a comparative advantage with almost all major importers. The results also show that India has the best comparative advantage in baby wear with the UK (RCA of 16.4) and with Poland (RCA of 9.8).

Another country that emerges as a potential market for Indian baby wear is Saudi Arabia. The demand for Indian baby wear is the highest in this region, occupying the largest percentage of 14.14 per cent ($55.77 million) in the total apparel exports, which is $394.32 million.

Future Outlook

India’s high comparative advantage in baby wear is particularly promising, especially with the impending India-UK FTA talks in the pipeline. India and the EU have also relaunched their free trade agreement negotiations in 2022. However, the UK’s decision to remove zero-duty benefits on India’s textile imports under its Developing Countries Trading Scheme (DCTS), effective from December 31, 2025, might pose challenges for the baby wear industry. Depending on the developments in these talks, it can be assumed that India is taking steps to secure agreements that will enhance the overall export scenario, particularly in the baby wear sector within the European continent.

India’s recent Comprehensive Economic Partnership Agreement (CEPA) with the UAE will also strengthen India’s foothold in the Middle Eastern region. The UAE has decided to grant duty-free access to the Indian garment industry, which will consequently lead to an increase in the exports of baby wear.

The India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) will also be a significant step for India to explore the African market, which has shown growing interest in Indian apparel products. India’s baby wear sector could particularly thrive due to higher birth rates in Africa compared to other regions worldwide.

These findings align with the strategy adopted by the Apparel Export Promotion Council (India), which plans to focus on emerging markets such as Saudi Arabia, Poland, and South Africa. Seventeen international trade fairs are being conducted worldwide with a special focus on these nations, as they could drive the apparel sector and the baby wear industry along with it.

Fibre2Fashion News Desk (NS)