With the world celebrating World Cotton Day, it is important to recognise the significance of cotton, not only for the textile industry but also for economies worldwide. Cotton, commonly called ‘white gold’, is produced in 75 countries and provides employment to millions of people. Globally, the sector relies heavily on labour, particularly in developing and underdeveloped nations, due to the dominance of agriculture. Additionally, in textiles, cotton is the most widely used material for producing apparel and home textiles. It accounts for around 27 per cent of total textile consumption, down from 60 per cent in the 1960s, according to the Food and Agriculture Organization (FAO).

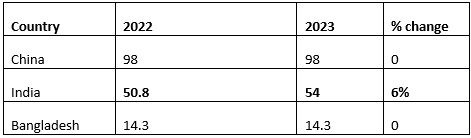

Exhibit 1: Cotton Statistics 2023

Source: Food and Agricultural Organization, The World counts

Given the significance of the cotton industry and the extensive forward and backward linkages across the supply chain, the upward trend in cotton production and supply is expected to continue, according to the USDA. Furthermore, organic and regenerative cotton, which focuses on resource conservation and optimisation while maintaining the quality of this white gold, is gaining prominence.

From an employment perspective, nearly half of the workforce engaged in cotton cultivation consists of women. Despite their dominant presence, there are widespread cases of gender-based exploitation, which has brought labour protection and fair wages to the forefront as key pillars of regenerative agriculture. Over the years, the sector has undergone significant changes.

Cultivated area, labour costs, and emerging cotton-producing countries

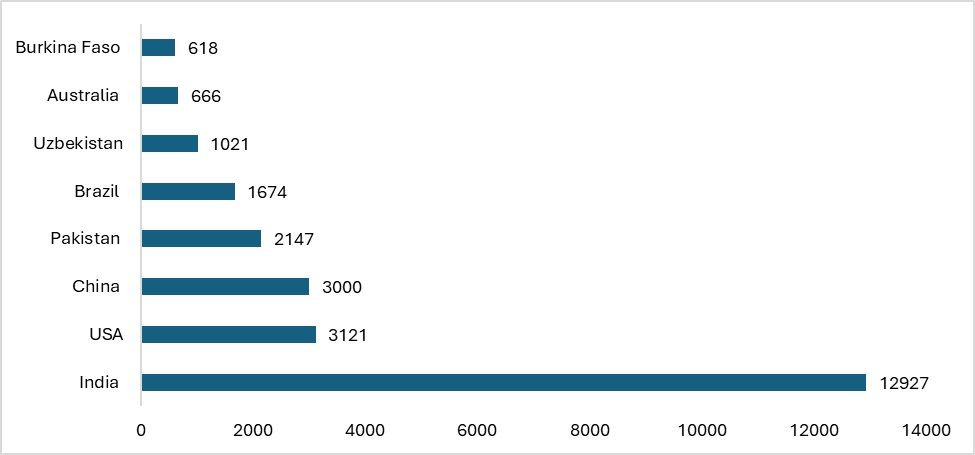

When examining the area under cultivation, India continues to dominate globally, with 12,927 hectares under production, followed by the US and China. India, the world’s leading cotton producer, saw only a marginal increase in its cultivated area in 2023, followed by a decline this year due to low yields. Contributing factors include climate change and the consequent deterioration in soil quality, along with water shortages, despite a significant drop in the cost of fertilisers.

Exhibit 2: Country-wise area under cotton cultivation (in ha)

Source: International Cotton Advisory Committee

Similarly, China experienced a significant decline in the total area under cultivation in 2023, with climate change, floods, and extreme temperatures impacting the annual cotton yield. The most common factors affecting both yields and the cultivated area for cotton have been climate change and water shortages, as well as extreme weather events such as floods and droughts. Although agriculture has been a key focus in global agreements like the Paris Agreement and COP conferences, much of the discussion has centred around energy transitions and reducing emissions, with the goal of cutting emissions by 2030.

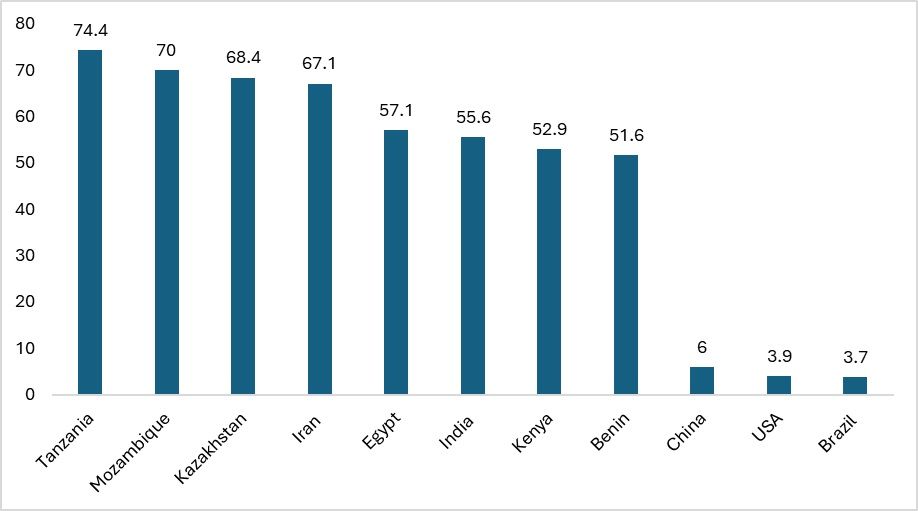

Exhibit 3: Labour cost as a percentage of the total cost

Source: ICAC

Labour costs as a percentage of total cultivation costs for cotton are highest in African and some Asian nations. However, in countries like China, the US, and Brazil, labour costs are significantly lower compared to nations such as India, Tanzania, and the C4 countries, including Benin. Given that cotton cultivation is highly labour-intensive, labour costs make up a large portion of the overall cultivation expenses. In China’s Xinjiang region, which is the country’s largest cotton-producing area and subject to international sanctions, labour costs are notably lower, resulting in a reduced percentage of total cultivation costs.

The C4 countries have emerged as new centres of cotton production, and the sector plays a crucial role in their economies. Since gaining attention in 2003, these cotton-producing nations have relied heavily on the crop as a key export commodity, accounting for over 30 per cent of exports and employing a large portion of the workforce.

During the WTO ministerial conference, major cotton-producing African nations urged the global community to address the issue of global subsidies. Textile exports from these countries are expected to grow at a compound annual growth rate (CAGR) of 16 per cent until 2026. However, agricultural subsidies and the impacts of climate change are reducing yields and weakening the export competitiveness of these nations—an issue that remains unresolved. Therefore, greater attention needs to be given to the issue of agricultural subsidies, especially for cotton, as many countries in Africa and Asia view cotton as a critical crop both economically and within the value chain.

Export prowess

India, China, the US, Pakistan, and Brazil have historically been the top exporters of cotton globally. However, in terms of exports, China has been on the back foot for the past five years due to COVID-19-related supply chain bottlenecks and the impact of international conflicts on its exports. In contrast, India and Brazil have seen significant growth in their cotton exports.

Looking at emerging export markets, Australia, Benin, and Vietnam are experiencing a positive boost in cotton exports. India and Brazil, followed by Benin, are among the rising exporters of cotton. However, apart from Benin, none of the C4 nations have yet secured a place among the top 15 cotton exporters worldwide.

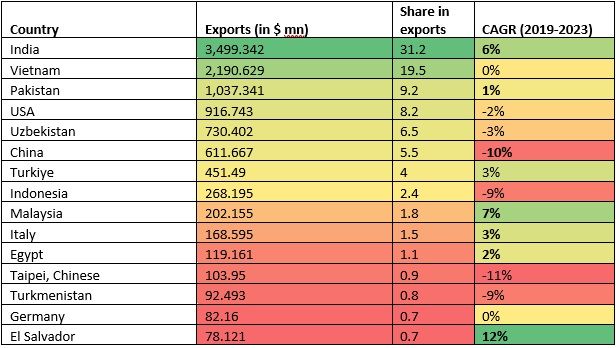

Table 1: Global cotton exports (in %)

Source: ITC Trade map, F2F analysis

Several factors have impacted global cotton exports, in addition to climate change, with one key factor being the demand for cotton from mills. In 2022 and 2023, demand declined due to reduced orders from apparel producers, driven by fears of recession and the cost-of-living crisis in major consumer markets like the US and the EU. India, despite facing challenges such as a bollworm infestation in 2023, which affected its exports, still managed to achieve a healthy growth rate of 3 per cent CAGR over the past five years. Australia, a more recent entrant into the cotton export market, experienced robust growth of 23 per cent during the same period.

In terms of cotton yarn exports, India, Pakistan, China, Italy, Egypt, and Malaysia were the leading exporters. India and El Salvador saw notable growth, with 6 per cent and 13 per cent CAGR over the last five years, respectively. India, in particular, witnessed substantial growth in cotton yarn exports, as many countries shifted their sourcing preferences from China to India, leading to a surge in demand and an increase in the country's exports of cotton yarn (HS 5205).

Table 2: Global cotton yarn exports (HS 5205)

Source: ITC TradeMap, F2F analysis

India’s cotton yarn industry is one of the fastest-growing industries globally. With the second-largest spinning capacity and the highest export value—$3,499 million as of 2023—the country also produces large volumes of cotton yarn. While much of this yarn is consumed domestically, a significant portion is exported. Cotton yarn production is expected to expand further due to rising domestic demand.

When comparing spinning capacities, India has shown a consistent increase, while China and Bangladesh have maintained steady production levels. Despite cotton prices stabilising in India, there remains a lingering threat to cotton yields, as many farmers are hesitant to sow cotton due to the bollworm crisis of 2023. Nevertheless, India’s spinning capacity is projected to grow as more countries prefer India as a sourcing destination, due to its comparatively stable environment.

Table 3: India’s spinning capacity (in mn)

Source: International Textile Manufacturers Federation (ITMF) Ministry of Textiles

As India's spinning capacities continue to expand, the country's export destinations remain largely the same. However, new potential markets are emerging due to the growing size of the textile and apparel industries in various regions.

Table 4: Volume of exports of cotton yarn from India to Bangladesh

Source: ITC Trademap, F2F analysis

India exports the highest volume of cotton yarn to Bangladesh, followed by China and Egypt. However, markets such as Portugal and Turkiye are showing potential for growth in their textile industries. Although Turkiye is currently facing economic challenges, its proximity to the EU makes it a preferred destination for EU countries to import textiles during periods of uncertainty or crisis, positioning the country’s textile sector as a potential hub for future growth. India's cotton yarn exports to Turkiye grew at a CAGR of 4 per cent, to Portugal by 24 per cent, and to Bangladesh by 16 per cent over the past five years (2019-2023).

Organic cotton

With the global shift towards more environmentally friendly commodities, agriculture is also adapting to this trend. The white gold’s cultivation has significant environmental impacts. Despite occupying only 2.5 per cent of the world's agricultural land, cotton consumes 16 per cent of global insecticides and 7 per cent of fertilisers. As a result, organic cotton is increasingly seen as a more sustainable alternative to conventional cotton.

Currently, only 1.4 per cent of all cotton grown and harvested globally is organic. In India, policies like the Paramparagat Krishi Vikas Yojana (PKVY) encourage farmers to reduce or eliminate the use of pesticides and insecticides in cotton cultivation, promoting the growth of organic cotton. Although global organic cotton production has increased by 37 per cent, much more needs to be done to ensure that textile value chains are fully traceable and organic, starting from the earliest stages of production.

Way forward

As the world celebrated Cotton Day on October 7, it is crucial to ensure that, while we maintain the economic significance of cotton cultivation and agriculture, the value chains within the textile industries become greener, more transparent, and traceable. With growing trade, expanding incomes, and potentially higher demand, countries must expand their production capacities and safeguard against shrinking installed capacity.

In the cotton sector, maintaining high profit margins can be difficult due to the seasonal variability in cotton yields, which significantly influences prices and reduces profit margins for firms. Additionally, ongoing geopolitical tensions present risks, as many countries may adopt de-risking strategies and nearshoring, which could potentially disrupt production capacities and profitability.

Countries like India and Vietnam, which currently enjoy a relatively stable environment, need to focus on increasing their production capabilities while leveraging this stability to ensure long-term growth and competitiveness in the global market. This adaptation will be key to staying resilient in a rapidly evolving and challenging global landscape.

Fibre2Fashion News Desk (KL)