The Turkish central bank’s decision to keep the interest rates, which were at 50 per cent since the month of March 2024, constant in the month of May indicates the attempts to normalise the economy. The country had a period of policy rate as low as 8 per cent in May 2023, which was hiked in a phased manner to finally 50 per cent in the month of March 2024. As a result, Türkiye has seen a rise in public spending aimed at boosting economic efficiency. Concurrently, the government plans to reduce public expenditure and investment under its current strategy to stabilise the economy, which is under constant pressure from inflation threatening to surpass the 70 per cent mark.

Unstoppable Inflation Growth

Türkiye’s economy has been under pressure due to costly pension schemes and steadily increasing minimum wage rates. Keeping the interest rates lower – in the range of 8 to 9 per cent in the year 2022 – intended to spur investments, has also contributed to the economy’s overheating. However, this strategy backfired, causing inflation to soar to the level of Venezuela. The new plan, announced on May 13, 2024, aims to reduce inflation to 36 per cent from the current 69.8 per cent. This marks a departure from the country’s traditional approach of expanding the economy by expanding public spending and keeping interest rates low.

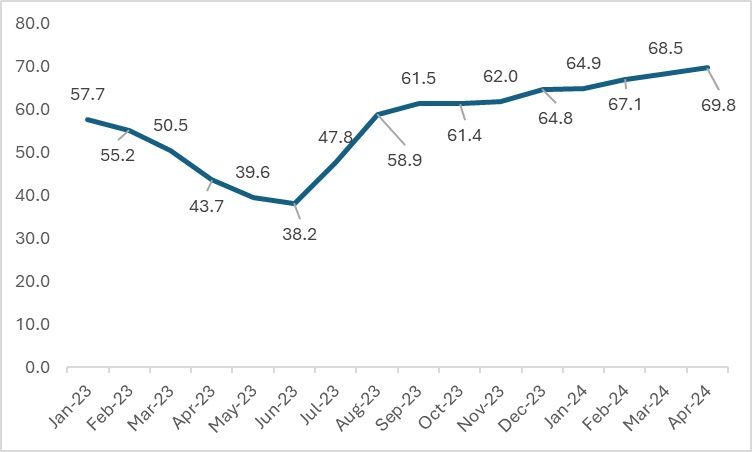

Figure 1: The Consumer Price Index (CPI) of Türkiye (in %)

Source: Central Bank of the Republic of Türkiye

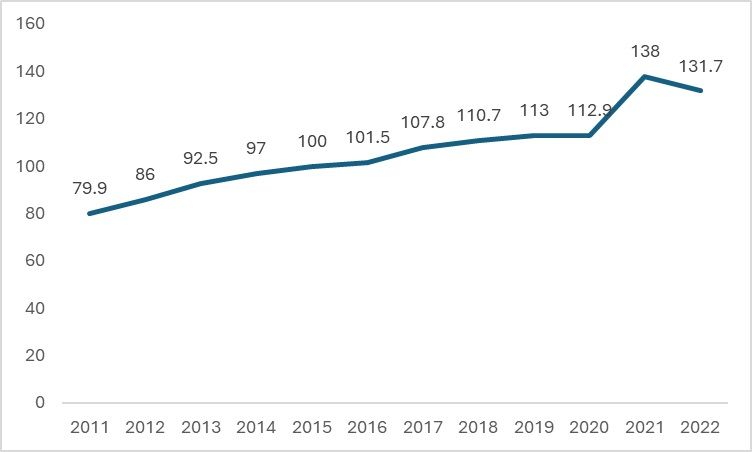

The inflation of the country has spiked up to 69.8 per cent in April 2024. This has resulted in the country getting into the SWAP agreement to give support to the foreign reserves in the central bank. Despite the COVID-19 pandemic, and the Russian invasion of Ukraine, the interest rates were low at 9 per cent in the month of February 2022, and were reduced as well in the same year, which resulted in higher inflation, and this dampened the industrial production of a lot of sectors in the upcoming year, with the textile sector the worst hit. The main reason for the current inflation is the higher minimum wage, rampant public spending, and costlier pension schemes, leading to the CPI being in the range of 61.5 per cent to 69.8 per cent from the month of September 2023 to April 2024. Public spending has a direct effect on inflation, the more spending, the higher the real income, the more the demand, and the higher the prices. But this also impacts the industry and the output.

Navigating Industry Challenges and Opportunities

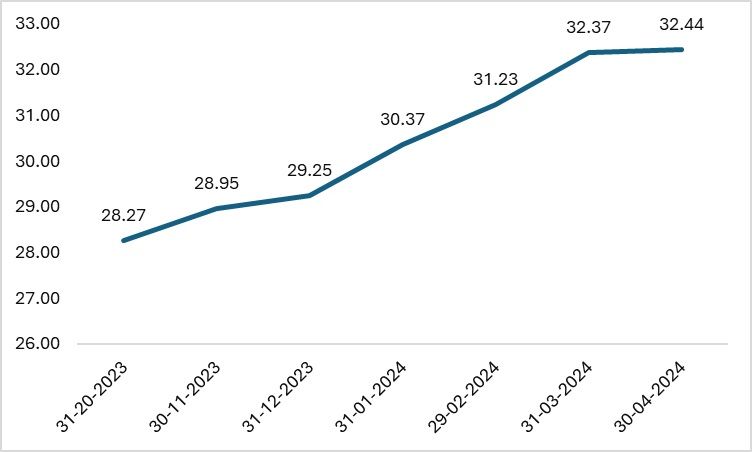

The country kept the interest rates at a lower level to stabilise the depleting currency reserves which were on a downfall since the pandemic. From October 2023, the currency has been steadily depreciating, and increasing at a rate of 1 to 2 per cent. This depreciation is closely linked to rising inflation: the higher the inflation, the greater the currency depreciation. Typically, a weaker currency should reduce imports and boost exports, as more expensive imports and cheaper exports make the latter more competitive on the global market. However, the country’s exports have taken a significant dip. This decline is primarily due to the soaring costs of raw materials and higher labour expenses, which have outweighed the competitive advantage of a depreciated currency.

Figure 2: Türkiye’s Currency Depreciation

Source: XE.com

Figure 3: The Industrial Production Index of Türkiye (in %)

Source: Türkiye Statistical Institute, Statista

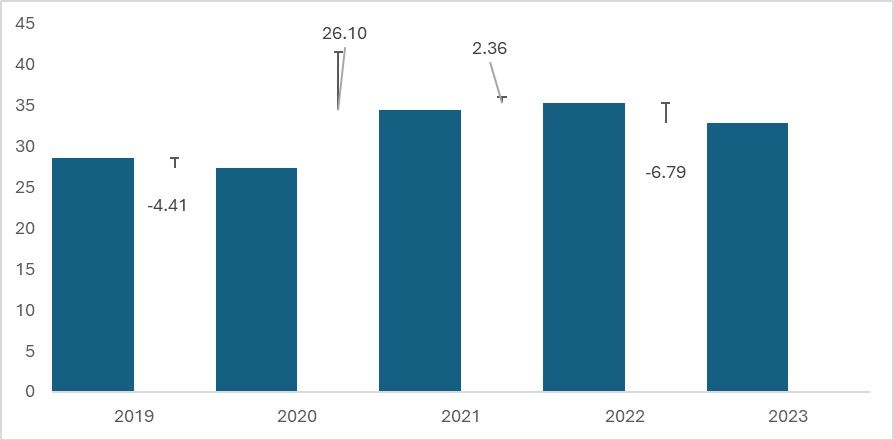

And the worst hit was the textile sector. Although the country should have benefitted largely from the currency depreciation, the domestic situation in the country was counterproductive to the country’s textile exports. The textile industry of the country was already hit due to the earthquake in February 2023, which led to major damage in the textile centres of the country, higher costs of raw materials due to the rampant inflation, and all of it also had a major impact on the textile exports of the country.

Figure 4: Textile Exports of Türkiye (in $bn)

Source: ITC Trade Map

The country’s textile exports reduced by 6 per cent in 2023 as a result of the causes mentioned above. If looked at the individual category exports, except silk and wool exports, exports from all the other categories declined in the range of 1 to 17 per cent. Exports of man-made fibres fell by 14 per cent, special woven textile fabrics by 9 per cent, knitted and woven clothing exports by 5 per cent and the exports of textile made-ups fell the most by 17 per cent. It must be noted that apart from the inflation soaring in the nation, the economic crisis in export partner countries, like the cost of living crisis, a risk of a lot of European nations falling into recession, and lower consumer demand leading to the retailers reducing the orders due to the US FED hiking interest rates in the US etc resulted in lower demand.

The current actions may lower the overall pricing – first of the raw materials and then eventually of the export products – helping the country to enhance its competitiveness further. The textile industry may see some relief amid a highly volatile global atmosphere and soaring energy and labour costs. With measures equal to austerity announced by the Turkish government which involves a cut on public spending and spending on only necessary infrastructure projects (announced on May 13) along with the rise in the interest rates to 50 per cent since March 2024, the next two years may see a rise in unemployment and a situation of contraction in the economy. With an ample labour force in the economy, labour costs and the minimum wage norms may also see a sign of relaxation thus leading to a reduction in the labour cost front. However, along with the reduction in the cost of labour, investments need to be looked upon with more caution. With the economy contracting, investment may reduce, which may again put a screeching break to the recovery of the economy.

What Lies Next

The current policy decisions of the country are poised to significantly impact exports. With the government reducing expenses across all sectors, domestic demand is expected to cool down, leading to a general decline in price levels. This could potentially benefit the manufacturing sector by lowering raw material costs. However, the drastic reduction in public spending will also significantly decrease consumer demand, which could negatively affect manufacturing output. The already struggling textile industry may face further challenges. Whether the government actions will have drastic effects on the overall economy remains to be seen, but the potential impacts on manufacturing and exports are critical areas for discussion.

Fibre2Fashion News Desk (KL)