The sensitivity of the global supply chain to the externalities

Global supply chains are extremely vulnerable to external events like war, natural disasters, and other geopolitical issues. As we live in a highly globalised world, the linkages of one country with the other also means that an issue in one country may affect the trade in the other countries.

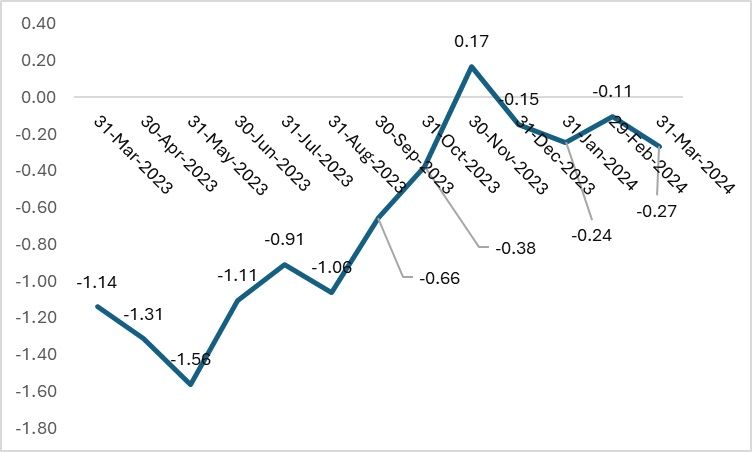

The Global Supply Chain Pressure Index gives a clear idea about the same. A positive value shows a high disruption in the supply chain whereas a negative value shows no disruption to the supply chain.

Figure 1: Global Supply Chian Pressure Index (in value)

Source: Federal Reserve Bank of New York

If seen currently, the value is at -0.27; down from -0.11 showing recovery of the supply chain. However, if such shocks continue to jolt key countries, the index may turn positive. In November 2023, i.e., around the period of the Houthi attacks, the value was positive.

Although the Index does not reflect a fall in the stability of the supply chain internationally, domestically there were some tremors experienced in the value chain. The reason for the same is the closure of the main railway lines and roadways. Closing this main logistical links in the supply chain leads to delay in shipment to destinations, causing minor cost disadvantages to the nations who import goods from Taiwan.

The trading partners affected

Taiwan’s major trading partners are China and the US. The recent event did not affect direct exports to these nations, but there are speculations about delay in exports during the upcoming month due to temporary halt of the main production lines.

US and China majorly import chips from Taiwan, and chip production was halted for the entire day, after the earthquake. Likewise, some textile firms had to stop operations for around 7 to 8 hours before resuming. Therefore, while exports are not likely to be affected majorly, there may be minor inconveniences.

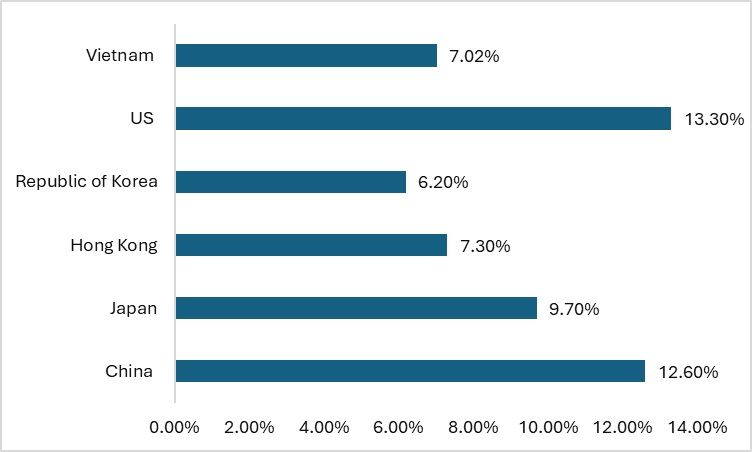

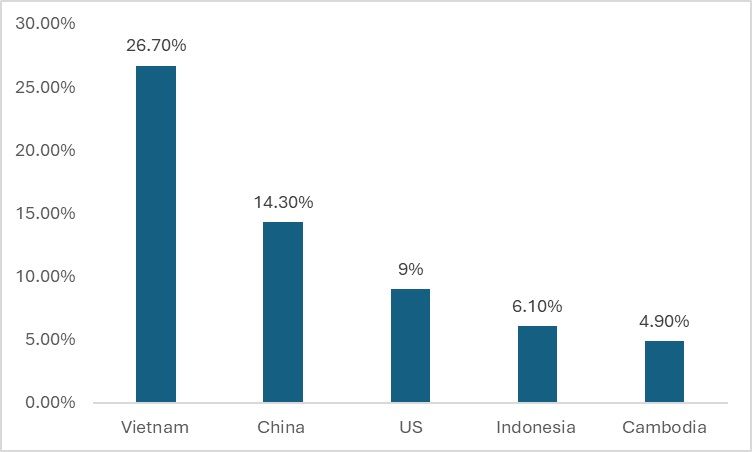

Figure 2: Major trading partners of Taiwan (in %)

Source: International Trade Administration

China is the largest trading partner of Taiwan followed by the US. China and Vietnam – which is the ninth largest trading partner of Taiwan – depend on the country for the intermediary goods required to produce hosiery. Thus, if the production, followed by the main logistical services leading to the key ports, is closed or delayed, the production lines in the destination countries will be affected.

How will it affect the textile value chain?

Asia is the production hub for the T&A industry. Almost all countries in some proportion or the other produce either the final products like apparel or are majorly involved in the production and export of the intermediate products required for manufacturing.

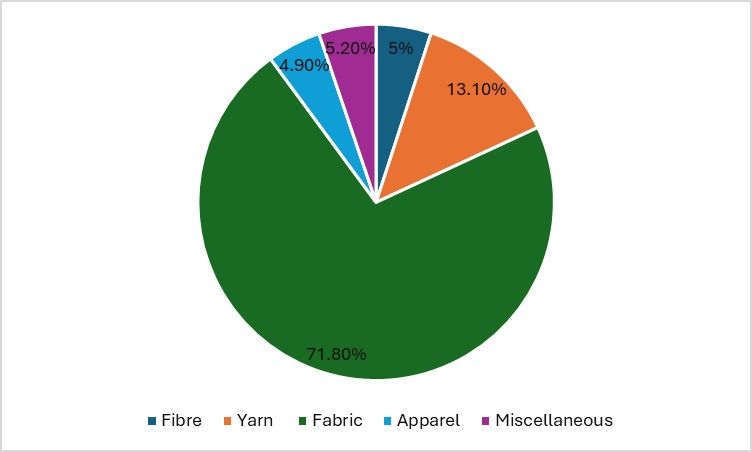

Taiwan is one of the countries which exports fabrics and yarns to the apparel and home textiles producing countries. According to the Taiwan Textile Federation data, fabric exports account for 71.8 per cent of the overall textile and apparel exports of the country, followed by the exports of yarn. Taiwan produces fabrics made from polyester and nylon, which are used in athleisure, urban outdoor clothing etc. Although the overall share of Taiwanese intermediary goods in the apparel exported by Vietnam and China may be minor, the latest disaster gives a slight idea of the potential impact a natural disaster can have on the supply chains.

Figure 3: Share of different textile components in exports for Taiwan ( in %)

Source: Taiwan Textile Federation

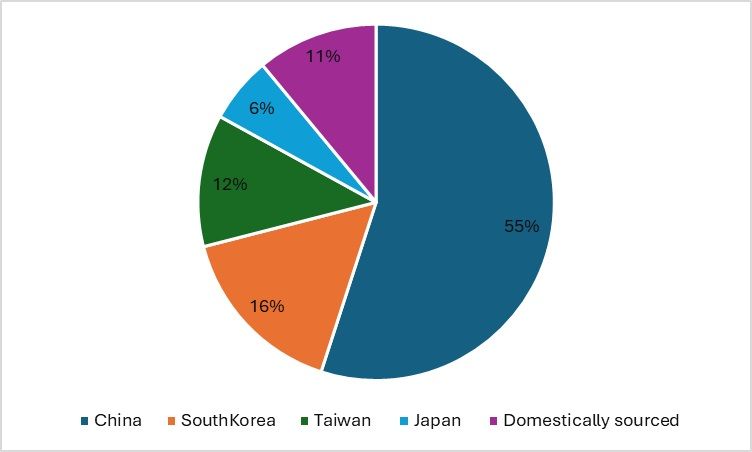

Figure 4: Vietnam’s sources of fabric imports (in %)

Source: East Asia Forum

Vietnam imports almost 12 per cent of fabrics from Taiwan, which is the third largest source of import. Therefore, if there is a long-term disruption in the transportation services connecting to the ports, it will impact the value chain in Vietnam and delay production. In addition, any short-term disruption will marginally affect the profitability of the firms too.

Figure 5: Taiwan’s top T&A export destinations (in %)

Source: Taiwan Textile Federation

More hiccups to be felt?

Although there are no reports of major damage to the factories and equipment, there will be minor damages that will be instrumental to be addressed. And, therefore, if not long-term, there may be a short-term disruption in the supply chain. And going by the simple economies of the production chain – if the supply of the intermediate goods is hampered; there will be a potential increase in the cost of production for the firms who rely on the same. Now if the problem lasts for the short term, the cost is unlikely to be passed on to the final consumer. But if the damage is major; higher are the chances of consumers facing the brunt of the same.

Fibre2Fashion News Desk (KL)