FTAs Losing Ground

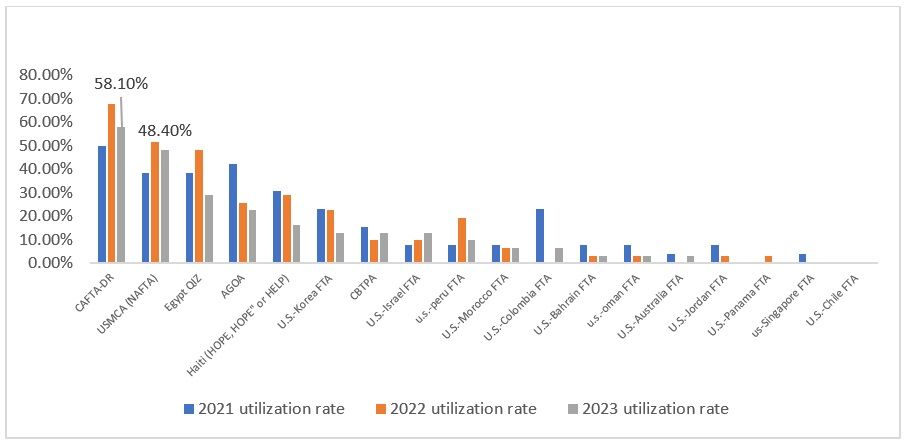

The underutilisation of FTAs, akin to old apparel left unused, has been a concern. These agreements, designed for equivalent market access among participant countries, are not meeting their intended goals. The CAFTA-DR, for instance, has been scrutinised for its rules of origin, especially as the US seeks alternatives to China, its largest source of apparel imports.

Duty-Free Access Hindered by Stringent Rules

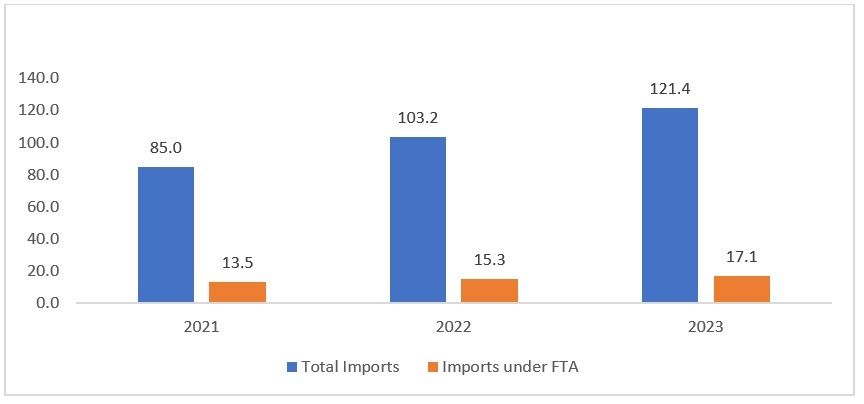

Under the ‘Yarn Forward’ rule, apparel exported back to the US from FTA-participating countries is eligible for zero duty only if the entire production process, from yarn to final product, occurs within these nations. This has significantly limited apparel imports under the FTAs to just 14 per cent of the total textile and apparel imports into the US.

Shifting Import Patterns

FTAs, intended to liberalise trade, are failing to do so. Nearshoring advantages remain unrealised, and companies are hesitant to use short-supply provisions. With stringent rules like De-minimis, limiting material sources to FTA countries, the agreements remain underutilised in textiles and apparel trade.

Figure 1: Apparel Imports from different regions (As a percentage of total imports)

Source: Office of Textiles and Apparels, United States

Declining Regional Imports

Yearly apparel imports from FTA regions like CAFTA-DR fluctuate around 9 to 10 per cent of total US imports. Similarly, imports under the NAFTA/USMCA agreement are at a mere 4 per cent. The dominance of imports from China and Vietnam further diminishes the effectiveness of FTAs.

Figure 2: Total Apparel Imports and imports under FTAs (In $Bn)

Source: Office of Textiles and Apparels, United States

Compliance and Utilisation Issues

A US Fashion Industry Association survey reveals a preference for sourcing from non-FTA countries like China. The utilisation rate of FTAs is at a 10-year low, with only 14.4 per cent of apparel imports qualifying as duty-free under these agreements.

Figure 3: Utilisation Rate of Different FTAs by the Fashion Industry in USA

Source: United States Fashion Industry Association report 2023

The Road Ahead

The challenge lies in balancing the easy availability of materials from countries like China and Vietnam against the rules of origin in FTAs. To enhance competitiveness and reduce apparel prices, there is a need to lower raw material costs sourced from FTA regions. Promoting products imported through CAFTA and NAFTA is crucial for ensuring mutual benefits among all participating nations.

This situation highlights a crucial period for US trade policy, as it seeks to find a balance between maintaining competitive imports and leveraging its FTAs more effectively.

Fibre2Fashion News Desk (MI WE)