Vietnam’s exports to the UAE are notably diverse, encompassing a wide range of products including electronics such as mobile phones, machinery, equipment, computers, and components. Additionally, Vietnam exports footwear, textiles, vehicles and parts, as well as agricultural products like cashews, pepper, fruit, and rice. This diverse export profile illustrates Vietnam’s strategic positioning in supplying various sectors of the UAE’s economy.

In terms of trade balance, Vietnam has consistently enjoyed a significant surplus with the UAE, exceeding $3 billion annually in 2022. This trade surplus underscores the strong export performance of Vietnamese products and reflects the UAE’s substantial import demand from Vietnam.

The economic relationship between Vietnam and the UAE has been further strengthened through a series of high-level interactions and agreements. Since 2007, the UAE has actively engaged with Vietnam through various diplomatic and economic channels.

Recent developments include ongoing negotiations for the Comprehensive Economic Partnership Agreement (CEPA), which is anticipated to be signed within 2024. This agreement is expected to further enhance trade and investment flows between the two countries. The bilateral relationship has been reinforced by frequent visits from top officials, including the recent visit of Vietnamese Vice President Thi Anh Xuan to the UAE and the visit of Sheikh Abdullah bin Zayed Al Nahyan, UAE Minister of Foreign Affairs, to Vietnam.

Trends and growth of Vietnam’s exports to the UAE: A historical perspective

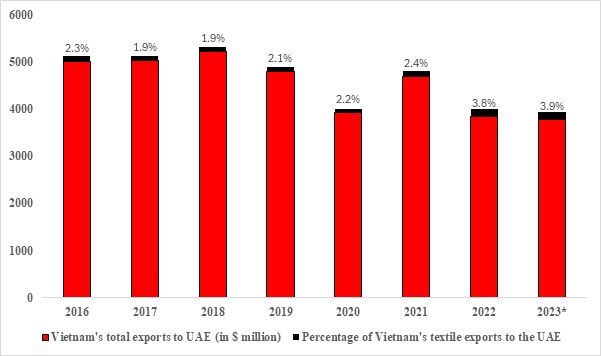

Figure 1: Vietnam’s total exports (in $ mn) and percentage of textile exports to the UAE

Source: TexPro, F2F insights

*Please note that values for CY2023 are estimated

Between 2016 and 2023, Vietnam's textile exports to the UAE have shown notable growth both in absolute terms and as a percentage of total exports. While total exports from Vietnam to the UAE fluctuated, peaking at approximately $5 billion in 2016 and projected to total $3.78 billion in 2023, textile exports have seen significant increases. By 2023, textile exports are expected to reach about $148 million, a substantial rise from previous years. As a percentage of total exports, textiles have grown from 2.3 per cent in CY2016 to an estimated 3.9 per cent in CY2023, highlighting the sector's expanding significance in Vietnam's overall trade with the UAE. This growth reflects the increasing importance of textiles within Vietnam's broader export strategy and underscores their growing role in enhancing bilateral trade relations.

India vs Vietnam trade and CEPA

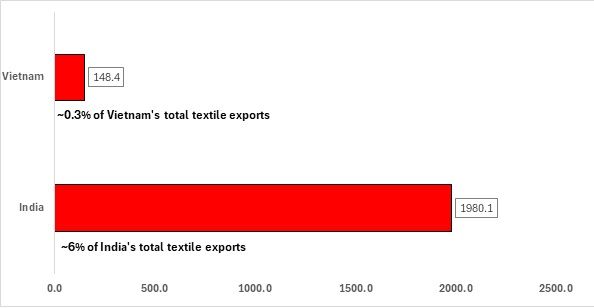

The India-UAE Comprehensive Economic Partnership Agreement (CEPA), which came into effect in May 2022, marks a significant development in the longstanding trade relations between the two nations. As a result of this agreement, India’s textile exports to the UAE have grown substantially. Currently, approximately 6 per cent of India's total textile exports are directed to the UAE, amounting to $1.98 billion in 2023. Notably, the UAE accounts for 12 per cent of India's total apparel exports, reflecting the country’s strong market presence. The CEPA provides a competitive edge by eliminating the 5 per cent import duty on ready-made garments (RMG) from India, positioning it favourably against competitors like China.

In contrast, Vietnam’s textile exports to the UAE are relatively modest, comprising only 0.3 per cent of its total textile exports. Despite this small share, Vietnam is also pursuing a CEPA with the UAE, which could potentially impact India's market position. Currently, India ranks second in terms of total textile exports to the UAE, while Vietnam holds the sixth position. As the dynamics of international trade evolve, India's prominent position may be challenged by other emerging players like Vietnam, underscoring the need for strategic vigilance and proactive measures to maintain its competitive advantage.

Figure 2: India and Vietnam’s exports to the UAE (in $ mn)

Source: TexPro, F2F Insights

Vietnam’s gain could be India’s loss

This is crucial information because Vietnam is one of the leading manufacturers of ready-made garments globally. Currently, Vietnam ranks third, right after China and Bangladesh. India has been making strides to catch up with the top three nations but has only managed to secure the 8th position, just behind Turkiye.

Vietnam has consistently demonstrated its leadership in the textile industry, particularly in the production of ready-made garments. The CEPA could play a significant role in expanding Vietnam’s currently limited presence in the Middle Eastern market.

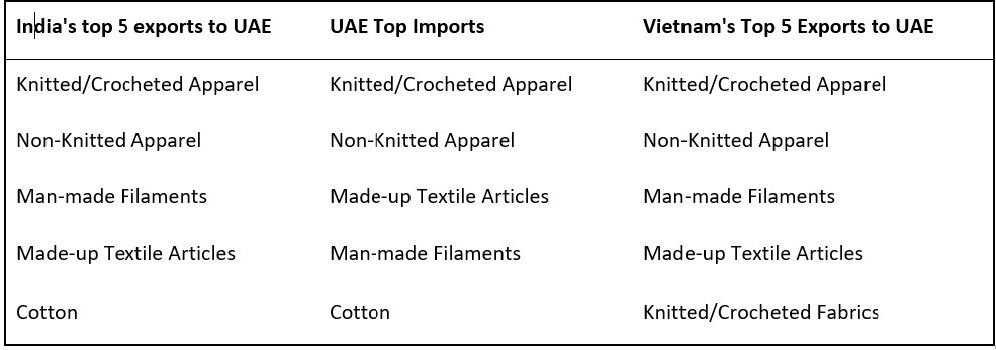

Comparison of India’s top exports, Vietnam’s top exports and UAE’s top imports

Figure 3: Top 5 Textile Exports of India and Vietnam; and UAE’s top 5 imports

Source: TexPro, F2F analysis

The table highlights India's strong presence across the top five textile products demanded by the UAE. India's dominance in cotton is particularly noteworthy, given the UAE's hot climate, which favours cotton for its breathability, hypoallergenic properties, heat resistance, and moisture absorption. In contrast, while Vietnam trails India in cotton exports, it excels in the other top four categories—especially in ready-made garments (RMG) and home textiles. Notably, Vietnam's strong focus on Knitted and Crocheted Fabrics is a defining aspect of its top textile exports to the UAE.

Given Vietnam's significant role in the ready-made garments sector, there is potential for increased competition between India and Vietnam in the apparel market. Vietnam's established presence in RMG underscores the need for India to enhance its capabilities in this sector to remain competitive.

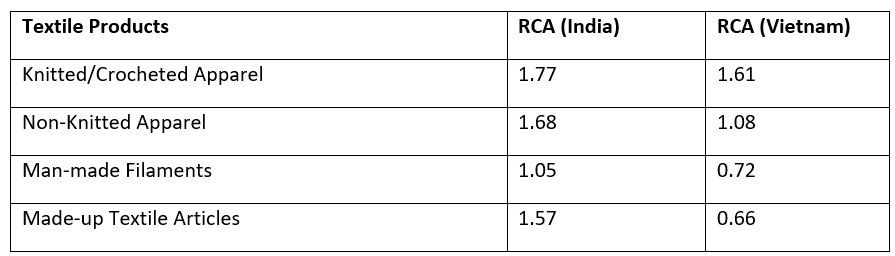

India vs Vietnam’s Revealed Comparative Advantage (RCA) in top 4 export products

To anticipate India’s future capabilities after Vietnam enters the market more strongly, it is essential to understand India’s comparative advantage in the top commodities exported by both South-East Asian countries.

Fig 4: RCA of India and Vietnam in 4 products

Source: F2F Analysis

India’s Strengths: India demonstrates a strong comparative advantage in apparel and clothing accessories (both knitted and non-knitted), as well as in other made-up textile articles. This indicates that India is more specialised and competitive in these textile categories compared to Vietnam.

Vietnam’s Relative Position: Vietnam shows a comparative advantage primarily in knitted or crocheted apparel but has a lower RCA in non-knitted apparel, man-made filaments, and other made-up textile articles. This suggests that Vietnam may concentrate more on specific segments of the textile market where it holds some advantages, but generally, it lags behind India in overall competitiveness.

Way Forward

India’s advantages

Diverse textile exports: India holds a comparative advantage across multiple textile categories, including both knitted and non-knitted apparel, man-made filaments, and made-up textile articles. This broad expertise and established presence in the UAE market reinforce India’s dominant position.

Significant Market Share: India’s textile exports to the UAE total $1.98 billion, with textiles comprising approximately 6 per cent of overall exports. The CEPA agreement, which eliminates the 5 per cent import duty on RMG, further strengthens India's competitive edge, especially against major competitors like China.

Vietnam’s Advantages

Rapid Growth in Specific Segments: Vietnam has demonstrated substantial growth in textile exports to the UAE, marked by a significant increase in the share of textiles within its overall export profile. If the CEPA negotiations are successfully concluded, they could further bolster Vietnam’s position in the market.

Strength in RMG: Vietnam ranks third globally in RMG production, and a CEPA with the UAE could potentially expand its market share in the Middle East, capitalising on its strengths in this high-demand segment.

The competitive landscape between India and Vietnam in the UAE textile market is shaped by India’s broader comparative advantage across multiple textile categories and its stronger established presence. However, Vietnam’s focused strengths in RMG production, coupled with the potential benefits of a CEPA, could enable it to capture a larger share of the UAE market. India must continue to leverage its advantages while innovating and expanding its RMG capabilities. Meanwhile, Vietnam should intensify efforts to strengthen its position across a wider range of textile products and fully capitalise on new trade agreements. The dynamic nature of international trade and evolving agreements will be crucial in shaping the future competitive landscape.

Fibre2fashion News Desk (NS)