Manufacturing business sentiment in Vietnam is expected to increase in the third quarter (Q3) this year amid unexpectedly higher domestic economic growth in Q2 and an optimistic outlook for the year, a government survey revealed.

Around 83 per cent of businesses expect improved or stable business activities in Q3 compared to Q2, while 17.1 per cent foresee greater trouble, the survey by the general statistics office (GSO) on production and business trends in the manufacturing, processing and construction industries for Q2 found.

The survey, covering 6,114 enterprises, also contained the forecast for Q3.

In the previous survey, 77.6 per cent of businesses forecast more favourable or stable production and business activities and 27.1 per cent had predicted higher levels of trouble.

Optimism, however, varies across different types of enterprises. State-owned enterprises lead, with 43 per cent predicting better conditions, followed by foreign direct investment (FDI) enterprises at 42.6 per cent, while only 39.6 per cent of private domestic enterprises project an improvement.

In contrast, 17.3 per cent of domestic firms anticipate tougher times, compared to 16.4 per cent of state-owned and 16.8 per cent of FDI enterprises, Vietnamese media outlets reported.

The two major challenges for the manufacturing and processing industry in Q2 2024 were low domestic market demand and high competition from domestic products.

Consequently, 28.9 per cent of businesses want the government to implement more effective measures to stimulate domestic demand and promote a campaign urging citizens to use indigenously-manufactured products.

Slightly more than a quarter of businesses surveyed want the government and local authorities intensify trade promotion efforts to explore new markets and partners.

Interest rates remain a significant challenge, with 22.3 per cent of businesses struggling due to high loan interest rates—up by 3.9 percentage points in Q2 2024 from Q1. Half of surveyed businesses want lower lending rates, while 28.2 per cent want banks to simplify loan procedures and conditions.

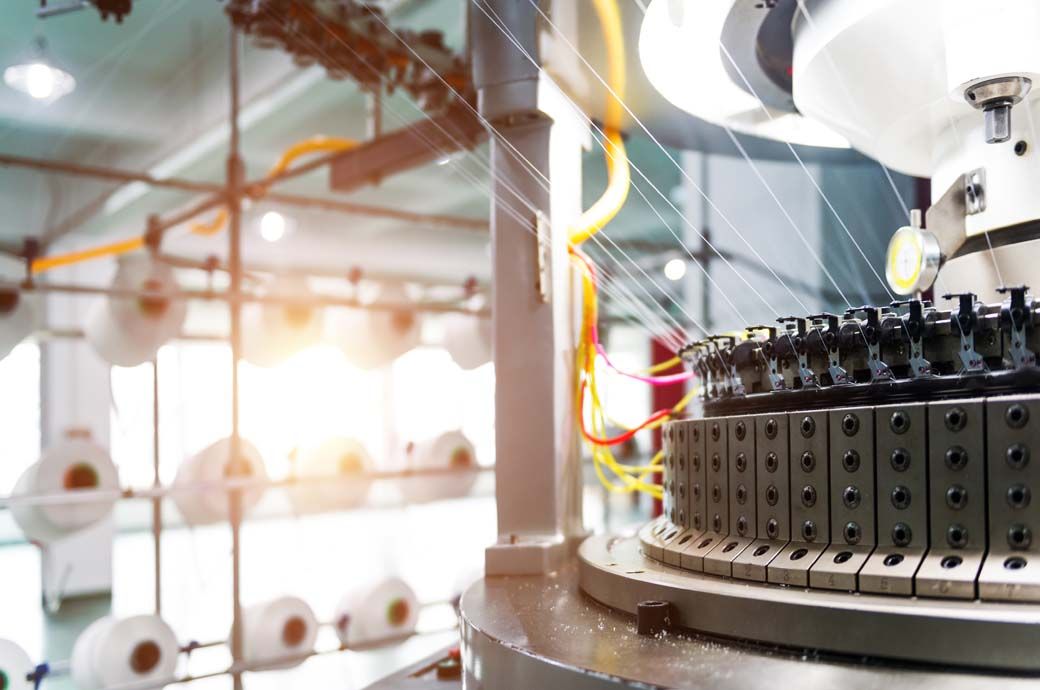

Textile and footwear enterprises face unique challenges, reporting difficulties concerning export orders and the skilled labour force. Consequently, 18.6 per cent of businesses want government support in training and upgrading the skills of workers to meet production requirements.

Additionally, 24.5 per cent of businesses have urged improvements in logistics services; 23.4 per cent have requested reductions in land rental costs for production and business activities; 22.4 per cent have emphasised the need for a stable power supply; and 31.5 per cent of businesses have called for continued reforms to reduce waiting times and streamline administrative processes.

Fibre2Fashion News Desk (DS)