A new opportunity stands on the horizon with the development of India's first dedicated transshipment port at Vizhinjam. This strategically located port in Kerala has immense potential to transform India into a prime transshipment hub in Asia. With the capability to handle shipments from Congo, Jebel Ali, and Singapore, Vizhinjam is set to significantly enhance India’s role in global logistics. The port's advanced infrastructure and strategic positioning will attract international shipping lines, driving economic growth and positioning India as a pivotal player in the transshipment landscape.

Understanding transshipment

Transshipment is the process where goods are offloaded at an intermediate station before reaching their final destination. These ports transfer goods from one ship to another, ensuring timely delivery. There are two types: silent transshipment, where transfers occur without informing the end consumer, and active transshipment, where consumers are informed.

Transshipment is cost-effective for long-distance consignments, often cheaper than direct transport. It also enhances security when direct routes are risky and is essential when changing the mode of transport. According to the European Port System, transshipment activity is high in Europe, Southeast Asia, the Middle East, Latin America, and the Americas.

Impact of transshipment ports on national revenue

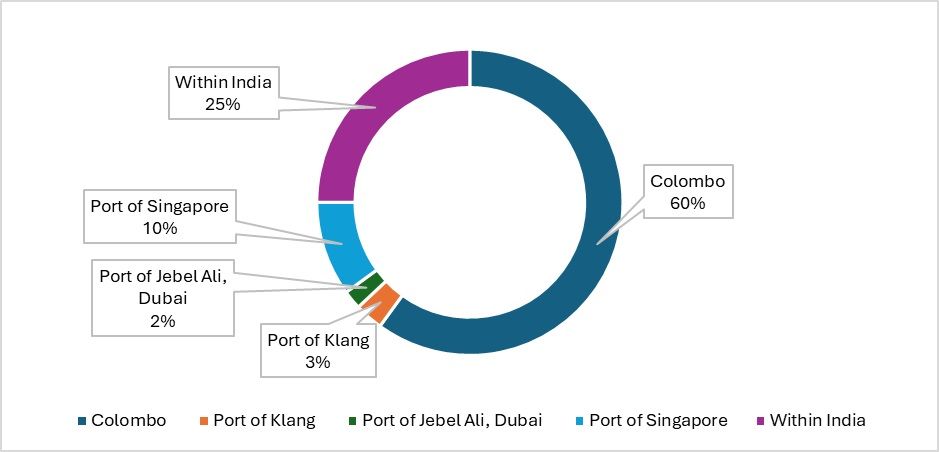

Transshipment ports can significantly boost a country’s revenue. According to the Ministry of Ports, Shipping and Waterways, approximately 75 per cent of India’s transshipment cargo is currently handled outside the country, with over 85 per cent managed by ports in Colombo, Singapore, and Klang. The development of new ports in India aims to transform the country into a global transshipment hub. Presently, around 25 per cent of transshipment is managed within India.

Transshipment for India (in %)

Source: India’s Ministry of Ports, Shipping and Waterways

Not having a transshipment hub has led to the loss of $200 to $220 billion in revenue for Indian ports. Having a port with this facility will boost India’s revenue and port traffic significantly. Container transshipments in Asia occur when containers are headed for the Far East from the US or Europe, Africa or Asia, or to India and the Indian subcontinent from the US and Europe. The African route is projected to grow by 6 to 7 per cent as the continent becomes a manufacturing hub. The coast of South India is one of the most strategically located regions in the country and can serve as the transshipment port for containers moving to Africa, the EU, or the East Coast of America. For this, the new port of Vizhinjam can open new gateways for India’s transshipment journey.

Adani Ports, that currently manages around 10 ports in India, manages the Vizhinjam port, which is capacity-wise one of the largest ports in the country. It will have the capacity to handle around 1 million twenty-foot equivalent units (TEUs) initially, with an additional 6.2 million TEUs in phase two. The port will be the only one in India capable of handling megamax containerships. This feature is absent in almost all other Indian ports. The port is also one of the first semi-automated ports, having welcomed its first mothership on July 11.

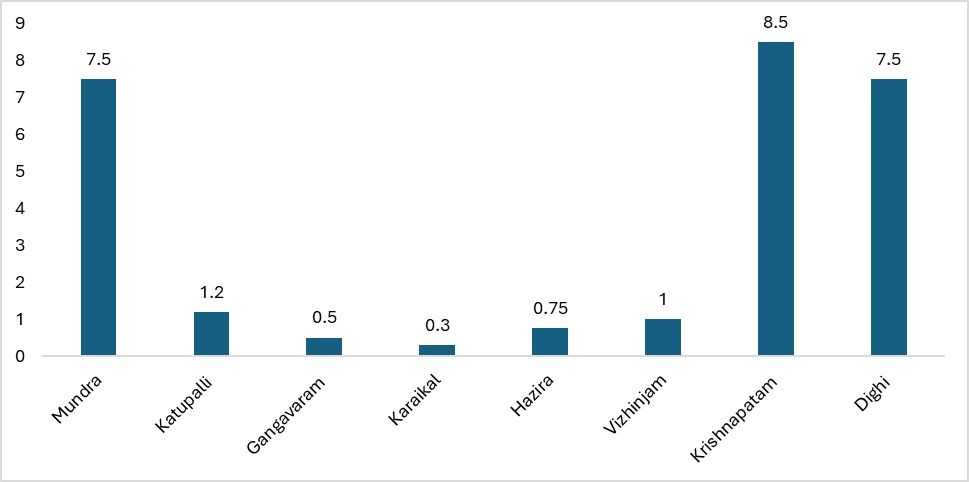

Capacity of ports handled by Adani (in mn TEUs)

Source: Adani

Strategically located just 10 nautical miles from the busiest international shipping routes that connect the Gulf, Europe, the US, and the Far East, Vizhinjam port has enough capacity to serve as a transshipment hub for cargo and vessels going long distances. This positioning can provide significant benefits to India. Compared to other ports managed by Adani, the new port will have a capacity of 6.4 million TEUs and the capability to berth motherships.

What are the benefits for India?

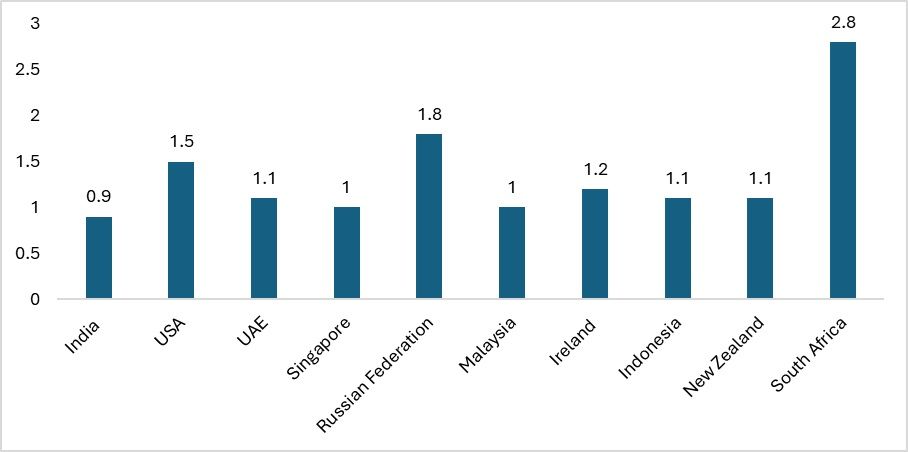

India stands to benefit greatly from this development. With Vizhinjam being one of the first transshipment ports in the country, India may gain more revenue by diverting ships from Colombo. Although customs processing times in India have been historically high, they have reduced drastically, making India one of the swiftest nations to clear vessels.

Country-wise turnaround time

Source: World Bank LPI 2023

The reduction in customs processing time and the new transshipment port could be the perfect combination for India to kickstart its journey towards becoming a global transshipment hub. However, the actual benefits will be visible only after operations are in full swing. Current developments in the country indicate a strong resolve to become a transshipment hub, with plans to develop two more ports for this purpose.

Road ahead

Logistics is an area where India has room for improvement. The LPI (Logistics Performance Index) ranking of India is 38, an improvement from the 44th rank in 2020. The current developments indicate efforts to enhance the logistics sector, which has been lacking. India has the advantage of a long coastline, and it is time to leverage this to emerge as a transshipment hub. However, India must offer greater benefits than Colombo or other Asian ports. Initially, it must be made viable for shipping companies to invest in such ports, and adequate infrastructure must be developed, including bunkering and crew change facilities. All ports should be equipped with mechanised berth operators to reduce time and costs. The facilities at the Vizhinjam port are only the beginning of this new journey for India.

Fibre2Fashion News Desk (KL)