After the heavy impact of the COVID-19 pandemic in the first half of 2020, the recovery – which started in the second half of 2020 – continued throughout 2021. Both the Weaving Machines activities (Picanol) as well as the other industrial activities (Proferro, PsiControl) showed a strong revenue increase.

The Adjusted EBITDA increased by 62 per cent compared to last year as fixed costs did not increase proportionally to sales. In the second half of the year however, the profitability was under severe pressure as the negative impact of rising component prices could not be fully translated into higher sales prices, partly due to the large order book, the company said in a press release.

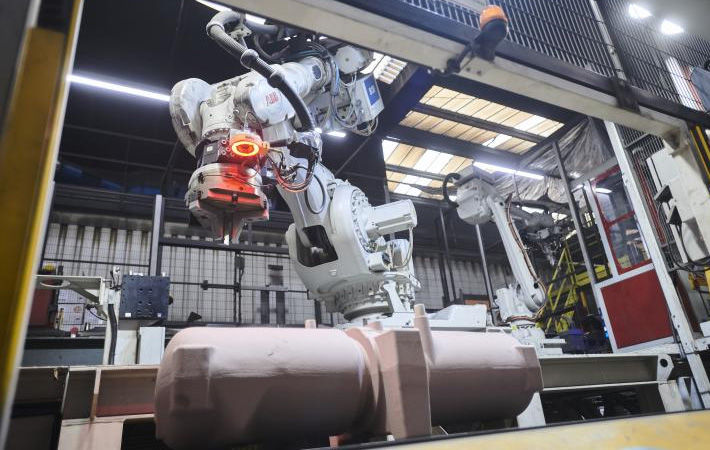

In the fourth quarter of 2021, Picanol launched its customer platform PicConnect. This is a new, fully digital platform offering a wide range of features from industrial IoT to service-related applications. In addition, Picanol introduced its latest generation of airjet and rapier weaving machines, which have been called the Connect generation. These new generation weaving machines focus on connectivity and an increased level of data availability (Machines & Technologies segment).

In the fourth quarter of 2021, the Performance Chemicals business unit changed its name to Kuhlmann Europe (Industrial Solutions segment). Kuhlmann Europe terminated its operating agreement in 2021 for the production of sulfur derivatives in Tessenderlo, Belgium (Kuhlmann Belgium). The deteriorating market conditions, the continuing limited availability of raw materials, and increased electricity prices made the sulfur derivatives activity economically unfeasible.

The 2021 profit amounts to €160.7 million compared to €55.4 million in 2020. The profit was positively impacted by exchange gains and losses, mainly on non-hedged intercompany loans and cash and cash equivalents in USD (+€15.3 million) and by the non-realised profit on the Rieter shares, resulting from the fair value revaluation at the share price of December 31.

Following the launch of the new Connect generation weaving machines in 2021, Picanol introduced the OmniPlus-i TC Connect in January 2022. This dedicated execution for the weaving of tire cord fabrics has now been upgraded to the latest airjet technology and combined with the Connect generation features.

The group anticipates a continued high level of uncertainty in 2022 due to the current conflict in Eastern Europe, the difficult supply chain circumstances, and other challenges following the Coronavirus pandemic. The group is faced with higher logistics, energy and raw materials costs, and this implies that our sales margin could come under pressure during the coming months. Based on currently available information, the group expects that the 2022 Adjusted EBITDA will be lower than that of 2021. This guidance does not include the risk of further deteriorating economic and financial market conditions.

Fibre2Fashion News Desk (RR)