Raymond Lifestyle Ltd, a key player in the Indian textile and apparel industry, has reported consolidated revenue of ₹12.49 billion (approximately $147.77 million) for the first quarter of fiscal 2025 (Q1 FY25), an 8 per cent decline from ₹13.54 billion in Q1 FY24. The decline in revenue has been attributed to subdued consumer demand, prolonged heat waves, general elections, fewer wedding dates, and inflation, which collectively impacted overall revenue performance and margins.

The total EBITDA for Raymond Lifestyle Ltd decreased by 52 per cent to ₹870 million in Q1 FY25, down from ₹1.79 billion in Q1 FY24, resulting in a drop in the EBITDA margin to 7 per cent from 14 per cent in the previous year, the company said in a press release.

In the branded textile (B2C) segment, revenue decreased by 18 per cent to ₹5.65 billion from ₹6.88 billion in the previous year. EBITDA for this segment was ₹560 million, down 53 per cent from ₹1.18 billion in Q1 FY24, with the EBITDA margin dropping to 10 per cent from 17 per cent. The branded apparel (B2C) segment saw revenue remaining almost flat at ₹3.03 billion, compared to ₹3.04 billion in Q1 FY24. However, EBITDA decreased by 25 per cent to ₹150 million from ₹20 million, resulting in a decline in the EBITDA margin to 4.8 per cent from 6.4 per cent.

The garmenting (B2B) segment experienced a revenue increase of 5 per cent to ₹2.52 billion from ₹2.39 billion. However, EBITDA for garmenting dropped by 62 per cent to ₹90 million from ₹240 million in the previous year, with the EBITDA margin declining to 3.5 per cent from 9.8 per cent. The high value cotton shirting (B2B) segment saw a revenue decrease of 3 per cent to ₹1.86 billion from ₹1.92 billion. EBITDA fell by 47 per cent to ₹100 million from ₹190 million, and the EBITDA margin decreased to 5.6 per cent from 10.1 per cent.

In the others segment, revenue loss was reported at ₹570 million, slightly better than the ₹690 million loss in the previous year. The EBITDA margin improved to 4 per cent from 2.6 per cent.

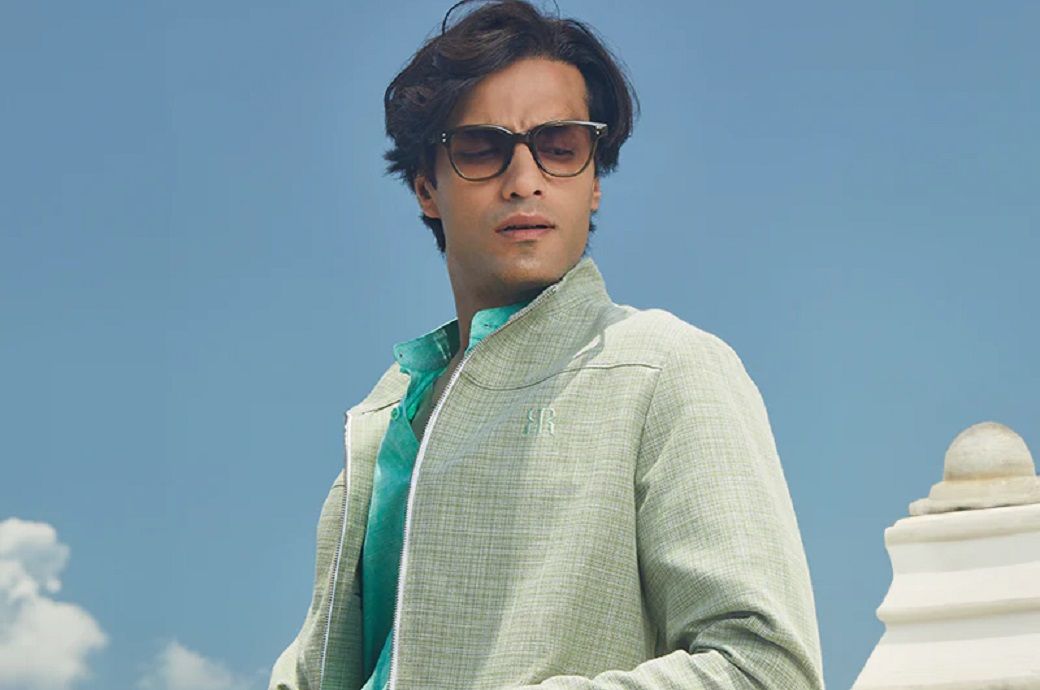

“We are satisfied with our business performance in Q1 FY25, which underscores the strength and resilience of our business strategy. During the quarter we have successfully demerged Lifestyle business into a separate company that will be listed in Q2 FY25,” said chairman and managing director, Gautam Hari Singhania.

Fibre2Fashion News Desk (DP)