Wacker more than offset lower prices, in particular for solar-grade polysilicon, but also for standard silicones and a number of other chemical products.

Wacker posted EBITDA of €272.9 million in Q3 2019, up 13 per cent compared to the previous year (€241.7 million) and 30 per cent higher versus the preceding quarter (€210.7 million). Special income was a decisive factor in this growth.

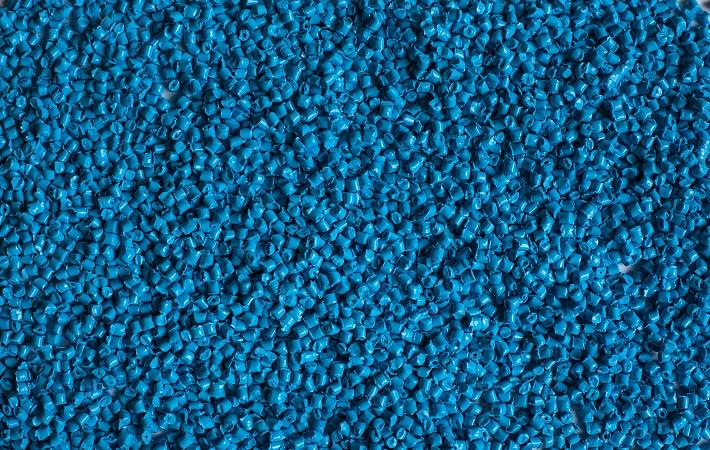

The main factors dampening earnings in the reporting quarter were substantially lower average prices for solar-grade polysilicon, lower prices for standard silicones and the effects of inventory valuation adjustments. In addition, an unscheduled plant shutdown at a raw-material supplier temporarily restricted polymer production at the Burghausen site.

Quarter-over-quarter figures were additionally influenced by the fact that in Q2 2019 Wacker retained €19.0 million in advance payments received under a contractual and delivery relationship with a solar customer. For the three months from July through September 2019, the Group posted an EBITDA margin, including insurance compensation, of 21.5 per cent (Q3 2018: 19.4 per cent).

In the first nine months of the year, Group EBITDA, including insurance compensation, amounted to €625.6 million. Without insurance compensation, EBITDA was €513.1 million in the first nine months of the year.

Group earnings before interest and taxes (EBIT) rose markedly and EBIT for July through September 2019 came in at €137.1 million (Q3 2018: €106.5 million), an increase of 29 per cent. Compared with Q2 2019 (€70.7 million), EBIT increased by 94 per cent. Net income for the reporting quarter amounted to €86.3 million (Q3 2018: €68.9 million) and earnings per share came in at €1.67 (Q3 2018: €1.31).

Wacker has previously lowered its guidance for full-year 2019, and the company expects Group sales for 2019 to be on par with last year (€4,978.8 million). Excluding insurance compensation, EBITDA is likely to be some 30 per cent below last year’s level (€930.0 million) and net income should be slightly positive.

“Despite increasingly difficult conditions, Wacker lifted its third-quarter sales versus last year and matched its prior-quarter figure,” said Rudolf Staudigl, Wacker’s CEO. “Given the ever-weaker global economic trend, that is a very solid achievement. On the other hand, we are not satisfied with our earnings performance. Although we posted strong EBITDA growth in Q3, this was due to special income. In operating terms, EBITDA fell quite significantly versus both last year and a quarter ago. We have started work on a comprehensive programme to weatherproof our earnings and competitiveness. Our aim is to prepare Wacker for future challenges, by making it more efficient and capable, and to achieve substantial cost savings. In the coming weeks, we will examine the whole organisation. We want to find out where to become leaner, where to combine functions, reduce tasks and organise processes even better. We must, and will, effectively counter the increasingly difficult conditions facing our business.”

Fibre2Fashion News Desk (RKS)