India is one of the leaders in textile production and exports. For the Indian economy, the textile industry is one of the largest employers after agriculture, employing around 40 million people directly and 100 million indirectly. However, the global economic outlook and the disruption in the Red Sea have led to a gloomier trade outlook. India faced the brunt of this global uncertainty.

Where exports faltered

The Indian exports are under pressure due to an interplay of domestic and international factors affecting the economy and manufacturing. Internationally, there is a significant increase in shipping costs and a lack of international orders, with a partial dependence on the EU and the US markets. Twenty-seven per cent of India's exports go to the EU and the US, which together account for a twenty-nine per cent share. Both regions are experiencing a period of economic uncertainty and a cost-of-living crisis, resulting in further declining demand and falling exports from supplier nations. India, a prominent supplier of textile goods, is significantly affected.

The most affected are apparel and jute goods used for packaging purposes. Thus, the fall in exports is substantial from the perspective of the financial year as well as from the calendar year perspective.

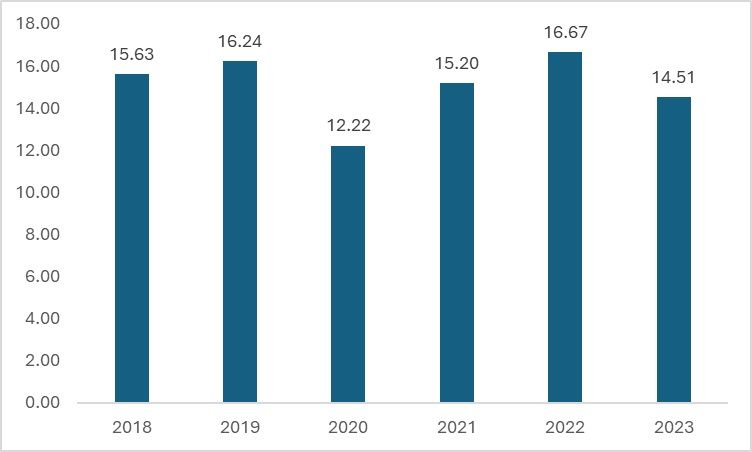

Figure 1: India's apparel exports (calendar year-wise in $ bn)

Source: UN Comtrade, DGCI&S

If viewed from the perspective of the calendar year, exports experienced a reduction of around 12.94 per cent, a 50 per cent smaller reduction compared to the 24 per cent contraction in the year 2020. India faces stiff competition from countries like Bangladesh, Vietnam, Sri Lanka, and China, and has some bottlenecks that particularly affect the industry negatively.

From the perspective of the financial year, the main reasons for the fall in exports is the rise in shipping costs due to attacks in the Red Sea and the inability of the Indian textile industry to renegotiate shipping costs with shipping dealers. Along with this, changes in the Quality Control Orders and a slower-than-usual rise in the Consumer Confidence Index are reasons why the industry is taking longer than usual to recover.

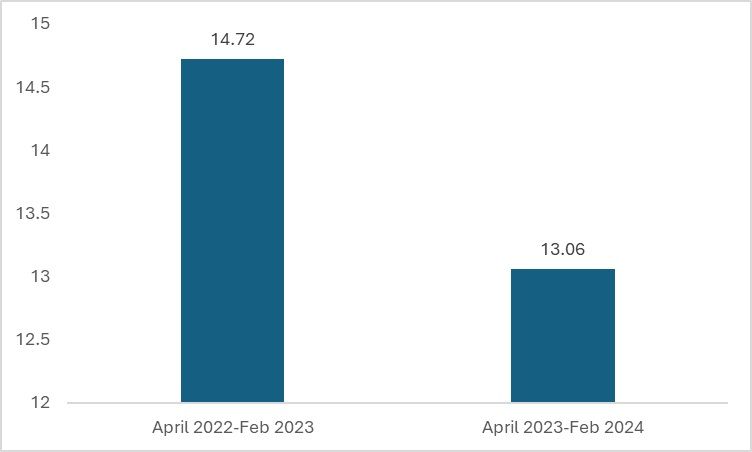

Figure 2: India's apparel exports (fiscal-wise in $ bn)

Source: Ministry of Commerce

If viewed from the perspective of the financial year, the situation remains similar. According to data from the Ministry of Commerce, apparel exports in the period from Aprill 2022 to February 2023 have shrunk by 11.42 per cent compared to the period from April 2023 to February 2024, followed by exports of jute manufacturing, including floor covering, which fell by 22.58 per cent in the same period. Compared with the period from Aprill 2022 to February 2023, Indian exports of jute manufacturing declined during the same period in FY24 as global manufacturing contracted against the backdrop of reduced demand. The major consumers of jute products, primarily in the EU and the US, opted for de-stocking, fearing a slowdown in these markets as the war continues.

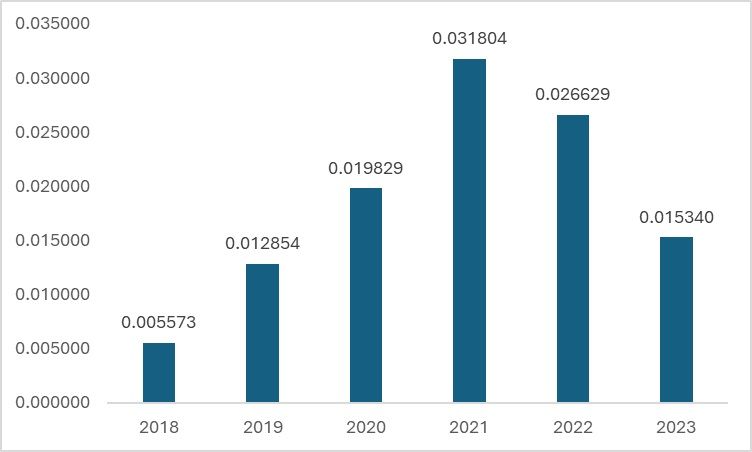

Figure 3: India’s exports of jute products including carpets (fiscal-wise in $ bn)

Source: Ministry of Commerce

Figure 4: India’s exports of jute products (calendar year-wise in $ bn)

Source: UN Comtrade and Ministry of Commerce

The overall fabric exports, as well as those of jute products, have experienced a significant downturn, as they depend heavily on the EU and the US for exports. The diminished demand from these regions has driven the total demand for jute in these markets downward. The use of jute imported by these countries is discretionary. However, the demand for jute in the domestic market remains stable due to its reservation in the packaging industry. There is a 100 per cent reservation for jute in grain exports and a 30 per cent reservation for sugar packaging, so jute now has a stable demand component domestically. However, the extent of support this provides for the entire supply chain is yet to be evaluated.

How lower export demand will affect India’s value chain

It's a matter of simple economics. When resources are used to produce commodities and the export demand—a critical component in these industries—diminishes, there will be reduced capacity utilisation. This could impact the industry's investment outlook over the medium term. Concerning the financial health of jute and apparel manufacturing companies, the lack of demand could tilt their balance sheets towards the negative, affecting their profitability.

Regarding the apparel industry, it faces stiff competition from countries like Bangladesh, Vietnam, Sri Lanka, and China. Therefore, it's crucial for the country to find solutions to ensure that the apparel and other export-intensive sectors remain resilient against sudden market changes.

What can be done?

India needs to diversify its export destinations. The EU and the US currently account for around 50 per cent of India's total textile and apparel exports. Apparel spending is considered a discretionary expense for average households; thus, in times of economic downturn, spending on apparel and textiles is likely to be impacted. Consequently, India should optimally leverage its various Free Trade Agreements (FTAs) to diversify its exports beyond these two regions.

Moreover, the impact of the US and the EU's onshoring and nearshoring efforts on supplier countries like India and Bangladesh remains to be seen. However, a stringent application of these strategies could significantly affect the value chain in these Asian countries. Factors such as employment, investment profitability in the textile industry, and sector growth could be adversely affected if exports decline sharply due to rapid implementation of nearshoring.

Therefore, as a supplier nation, India must ensure it has a diversified portfolio of consumer countries to maintain export stability in case of an economic crisis in any one country.

Fibre2Fashion News Desk (KL)