The entire Middle East region is vulnerable to the potential region-wide war due to the Israel-Hamas conflict and Iran's involvement in it. This conflict has far-reaching effects, impacting logistics, trade, and ultimately the region's economy. Given the heightened regional tensions and geopolitical complexities, economic stability and trade policies will play a crucial role in shaping future trade dynamics.

How has the situation affected textile trade?

The ongoing conflict has triggered a cascade of economic repercussions across various fronts. There's been a notable shift in policy orientation, with many nations veering towards protectionism from previously liberal stances. This change has prompted a re-evaluation of export destinations, coinciding with an unusual strengthening of the dollar and a spike in energy prices. This development, coupled with pervasive economic uncertainty, has led to a profound impact on global trade dynamics.

Supply chain disruptions have exacerbated the situation, fuelling steep inflation in both developed and developing economies. Attacks on vital shipping arteries like the Suez Canal have further compounded these challenges, driving up the costs for suppliers worldwide. Consequently, trade patterns in 2023 have undergone significant transformations, giving rise to new routes and intermediary countries that serve as vital links to major consumer markets such as the US and the European Union (EU).

Among the hardest-hit sectors is textiles, largely due to its classification as discretionary spending. The fluctuation in consumer demand for these goods mirrors the economic landscape, which directly influences consumer incomes. Thus, the textile industry's fortunes are intricately tied to broader economic circumstances and consumer sentiment.

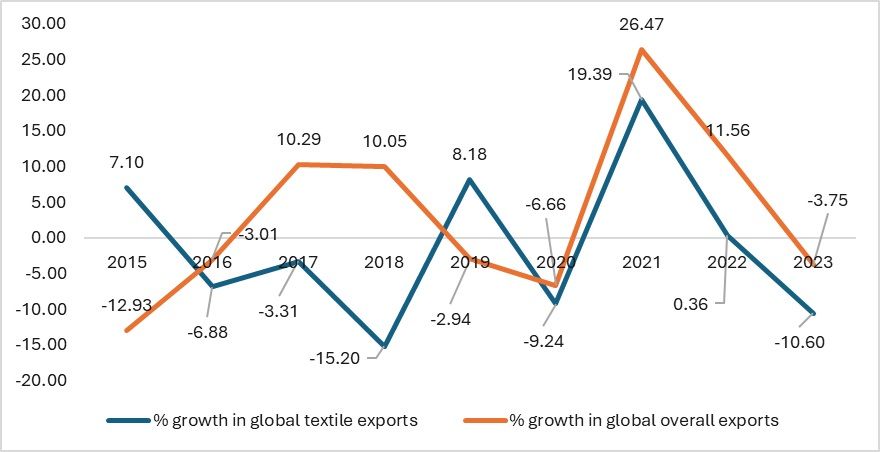

Figure 1: Growth in global exports and global textile exports (in %)

Source: ITC Trade map

Textile exports worldwide had fallen by 10 per cent, followed by a 6 per cent decline in clothing exports in the year 2023, due to supply chain constraints, a decrease in demand for apparel products from the EU and the US, and an overall downturn in the economy of the supplying countries. Textile exports saw a major decline compared to the fall in global trade. The onset of the cost-of-living crisis and inflation, along with heightened energy prices, led to declines in all aspects of the value chain: production, supply, and demand.

Suez crisis and its impact on trade and retailers

The textile trade faced additional challenges stemming from the disruption caused by Houthi attacks on the Red Sea, necessitating the rerouting of traffic through the Cape of Good Hope. This redirection led to prolonging transit times for goods from textile-exporting Asian countries to their primary market, the EU. The repercussions were profound, resulting in a notable reduction in the overall volume of textile trade.

Persistent attacks by the Houthis have further exacerbated the situation, driving up container prices and premiums. For instance, Chinese exporters have experienced a staggering 67 per cent increase in the price of a 40-foot container, as reported by a monthly forecaster report from Container Xchange. Such price hikes in container transportation can significantly impact commodity exports, potentially influencing prices in importing countries.

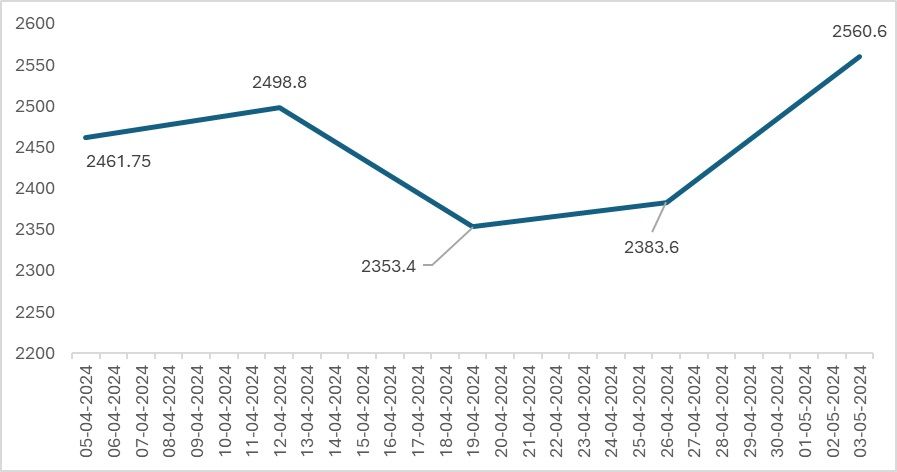

Figure 2: Container costs globally (in $)

Source: Freightos

The surge in container prices, particularly by 7 per cent, is poised to significantly impact retailers by adding to the overall import costs, thereby affecting global merchandise trade. The redirection of traffic from the Suez Canal to the Cape of Good Hope, notably for the Asia to Europe route, has witnessed an astounding price hike of 300 per cent within just six months. While stability has been achieved on the new route, geopolitical uncertainties persist, exerting upward pressure on container prices.

The repercussions of the conflict have hit the retail sector hardest, particularly in the US and the European Union (EU), where higher import prices and increased shipping costs have taken their toll. Imports of apparel and footwear have borne the brunt of these challenges, with major US retailers heavily reliant on Asian suppliers. EU retailers, facing a 20 per cent surge in delivery costs due to escalating shipping expenses, also contend with prolonged delivery delays. This dilemma leaves retailers grappling with whether to pass on the additional costs to consumers or absorb them themselves, with many opting for the latter to remain competitive.

Meanwhile, suppliers find themselves caught in a bind, as heightened risks prompt them to either retain their stocks or shoulder rising prices. Bangladesh, heavily reliant on the Suez Canal for approximately 80 per cent of its exports to the EU, finds itself bearing the brunt of increased costs. Similarly, countries like India are withholding exports due to escalating insurance premiums and shipping costs, while Pakistan struggles with delays in fulfilling orders due to raw material shipment delays and escalating shipping expenses. The textile supply chain is thus grappling with the cascading effects of the crisis.

Emergence of the connector countries

According to the IMF, the current conflicts and uncertainties have led to the emergence of non-aligned countries (members of the Non-Aligned Movement—a forum of 120 countries since the Cold War) and their increasing share in US imports. For example, while China’s share in US imports has been consistently declining, the share of countries like Mexico and Vietnam has been increasing, as demonstrated by the data.

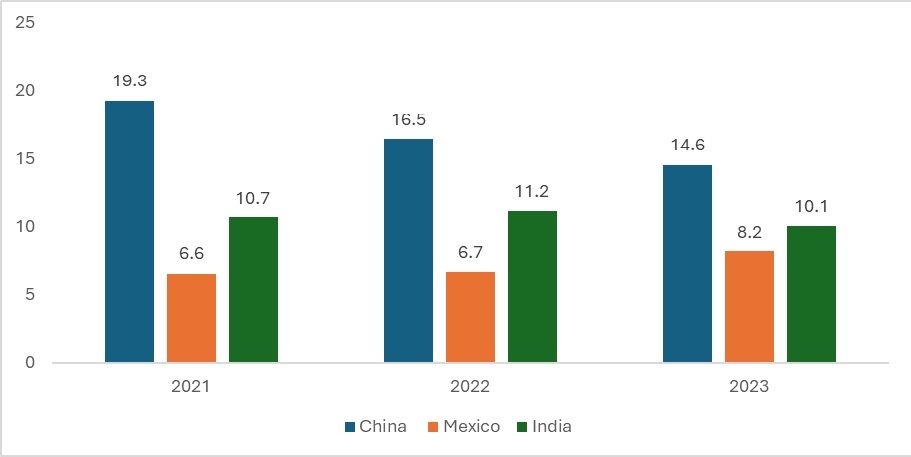

Figure 3: Share of China, Mexico and India in US’ total textile imports (in %)

Source: ITC Trade map

The increasing uncertainty and crisis, followed by a strong sentiment to produce goods nearer to the home country, have led to Mexico gaining a significant share in US textile imports. Regarding world apparel exports, China is experiencing a reduced share, while countries like India and Mexico are seeing a marginal increase in their export share.

Impact on the exchange rate

With global uncertainty and geopolitical issues, the USD has become the safest currency to invest in after the Japanese Yen; the dollar has gained enough strength in the year 2023. The US Federal Reserve on the other hand has kept the interest rates higher which has led to a consistently stronger trend for the dollar.

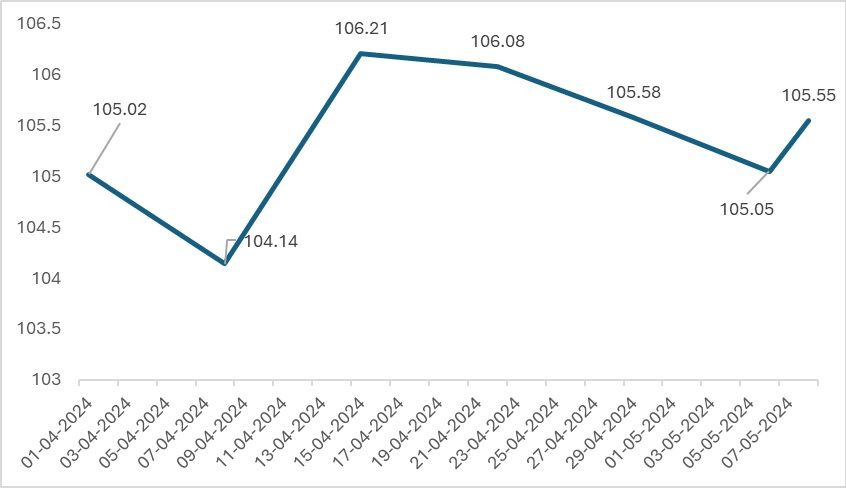

Figure 4: Dollar Index (DXY)

Source: MarketWatch, Inc

Additionally, higher oil prices are contributing to the strengthening of the dollar. The dollar index is consistently rising, underscoring the greenback's growing strength against most global currencies. Despite a noticeable trend towards de-dollarisation, the dollar remains the currency of choice, particularly during periods of uncertainty. Given the uptick in attacks on ships in the Red Sea and the potential for escalated conflict in the Middle East, coupled with increasing oil prices driven by the Organization of the Petroleum Exporting Countries (OPEC), the dollar is likely to continue its upward trajectory.

Road ahead

The ongoing conflict in the Middle East has spurred nations to grapple with reducing their shipping costs. As the crisis persists and uncertainty looms over its resolution, countries in the EU and the US could face prolonged spikes in delivery costs, placing considerable pressure on retailers to eventually pass these increases on to consumers. This scenario underscores the precarious balance retailers must strike between absorbing costs and maintaining competitiveness.

Amidst the prevailing global uncertainty, there is a growing likelihood that the dollar will continue to strengthen while trade activity remains subdued in the absence of swift resolutions to the conflict. However, despite these challenges, there is a glimmer of hope on the horizon. Many economies are gradually rebounding from the shocks endured in 2022-2023, suggesting a potential for slight improvements in trade conditions. This cautious optimism offers a silver lining amidst the prevailing uncertainty, hinting at the possibility of a gradual recovery in the trade landscape.

Fibre2Fashion News Desk (KL)