The report is part of the ‘The Economy 2030 Inquiry: Shaping a Decade of Change’ funded by the Nuffield Foundation.

First, in the immediate aftermath of the referendum, and in anticipation of permanent impacts, household incomes and business investment were affected.

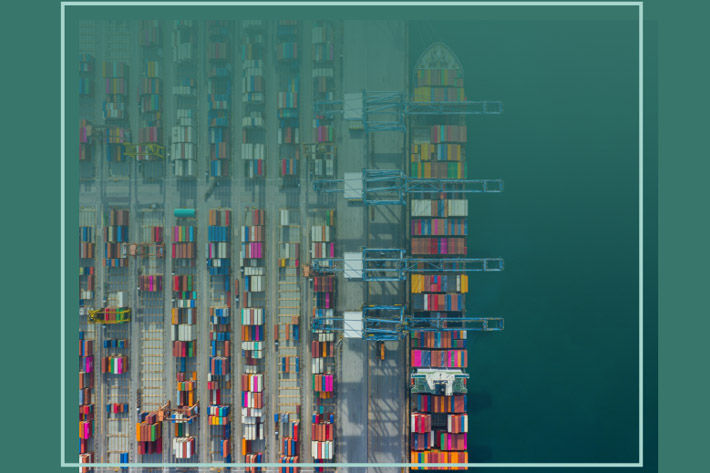

Second, trade itself responded following the implementation of the new Trade and Cooperation Agreement and the new barriers that this introduced.

And third, structural changes to the UK economy will take place over the long-term, as capital and labour adjust to the new trading arrangements.

Overall, the report says, the long-run impact will mean significant change for some sectors of the UK economy, but the aggregate effect will be to reduce household incomes as a result of a weaker pound, and lower investment and trade.

This adjustment will be substantial, but the report does not expect it to fundamentally alter the nature of the UK economy, including the UK’s overall services focus and export specialisation.

UK business investment fell by 0.1 per cent a quarter on average in the three years post-referendum, compared to growth of 1.7 per cent a quarter on average growth in the previous three years, and ongoing growth in other G7 countries.

Firms expect this decline in investment to taper off now that Brexit-related uncertainty has fallen, but the United Kingdom’s relative investment position remains weak as it emerges from the pandemic, the report says.

The driver of investment underperformance has not been the widely expected fall in foreign direct investment (FDI), an important driver of productivity and innovation.

UK FDI inflows as a percentage of EU-27 inflows has remained above pre-Brexit levels since the referendum and, despite a decline in the UK’s share of global FDI, it remains in line with that in Germany and higher than France.

European Union (EU) trade data shows that the UK’s share of total EU goods imports fell by more than a quarter between 2020 and 2021, more than double the fall of some large non-EU partners, such as the United States.

There are signs that UK firms are using ‘coping strategies’ to help ease the short-term adjustment to the new trading relationship with the EU, the report says.

But it will take many years for the UK economy to fully adjust, as firms gradually wind down capital invested in EU exports, the labour market adjusts and changes to the rate of exit and entry of firms across sectors affects the structure of our economy.

The analysis finds that although there is uncertainty over the Brexit impacts that have occurred to date, not the least because of the entangled COVID-19 impact, the lasting impact of reduced openness should be expected to be substantial, and to lead to widespread productivity and real income shocks, much of which has already taken place.

Although some sectors will be very significantly affected, changes to the broad sectoral structure of the economy and the UK’s export specialisation are set to be relatively small, the report adds.

Fibre2Fashion News Desk (DS)