This will strengthen the registration process in GST and will help in combating fraudulent input tax credit (ITC) claims made through fake invoices, a press release from the country’s finance ministry said.

It also recommended that the GST rate on ‘carton, boxes and cases of both corrugated and non-corrugated paper or paper-board’ (HS 4819 10; 4819 20) be reduced from 18 per cent to 12 per cent.

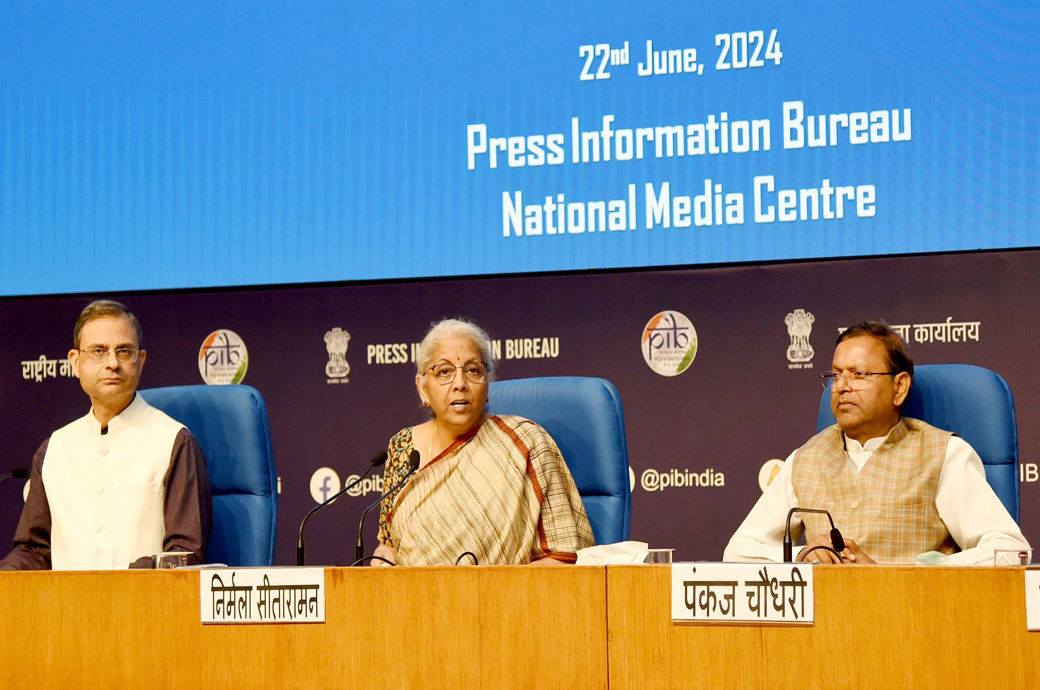

The Council, which met under the chairpersonship of finance and corporate affairs minister Nirmala Sitharaman, made several other recommendations relating to changes in GST tax rates, measures for facilitation of trade and measures for streamlining GST compliance.

These include exempting compensation cess on imports in special economic zones (SEZs) by SEZ developers for authorised operations with effect from July 1, 2017.

Considering the difficulties faced by taxpayers during the initial years of implementation of GST, the Council recommended waiving interest and penalties for demand notices issued under Section 73 of the CGST Act for fiscals 2017-18, 2018-19 and 2019-20 in cases where the taxpayer pays the full amount of tax demanded in the notice up to March 31, 2025. The waiver does not cover demand of erroneous refunds.

E-commerce operators (ECOs) are required to collect tax collected at source (TCS) on net taxable supplies under Section 52(1) of the CGST Act. The Council recommended reducing the TCS rate from present 1 per cent to 0.5 per cent to ease the financial burden on the suppliers making supplies through such ECOs.

The Council also recommended prescribing monetary limits, subject to certain exclusions, for filing of appeals by the department before GST Appellate Tribunal, high courts and the Supreme Court to reduce government litigation.

Fibre2Fashion News Desk (DS)