Oerlikon, a leader in polymer processing and additive manufacturing. has recorded an increase in orders globally by 34.6 per cent to CHF 643 million in the first quarter. Sales improved by 7.2 per cent to CHF 568 million, which is attributed to an increase in demand in the filament equipment, automotive, and tooling industries in China and India.

At constant exchange rates, group sales increased year-over-year by 7.5 per cent to CHF 569 million. Operational first-quarter EBITDA was CHF 88 million, or 15.6 per cent of sales, representing a year-over-year improvement of 420 basis points (bps). First-quarter operational EBIT was CHF 39 million, or 6.9 per cent of sales (Q1 2020: CHF 9 million; 1.7 per cent). The margin improvements were driven by benefits from structural cost actions, positive operating leverage and a better business mix in Surface Solutions. Group first-quarter EBITDA was CHF 88 million, or 15.4 per cent of sales (Q1 2020: CHF 58 million, 11.0 per cent), and EBIT was CHF 38 million, or 6.7 per cent of sales (Q1 2020: CHF 6 million, 1.1 per cent). The reconciliation of the operational and unadjusted figures can be seen in the tables below, according to a press release by Oerlikon.Oerlikon, a leader in polymer processing and additive manufacturing. has recorded an increase in orders globally by 34.6 per cent to CHF 643 million in the first quarter. Sales improved by 7.2 per cent to CHF 568 million, which is attributed to an increase in demand in the filament equipment, automotive, and tooling industries in China and India.#

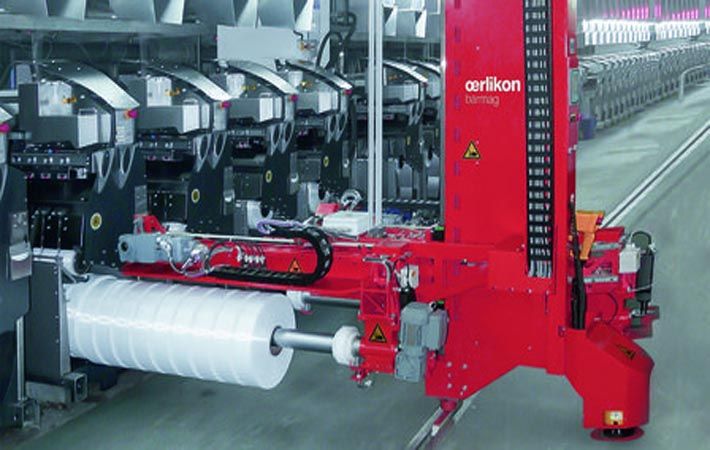

The agreement to acquire INglass, as announced on April 23, 2021, marks a strategic step for Polymer Processing Solutions, which was previously named Manmade Fibers. This move is in line with the division’s growth strategy to reposition itself and gain a strong foothold in the polymer processing market. This strategic acquisition will accelerate and enhance the division’s organic initiatives to grow its polymer processing capabilities and products, as it further diversifies into new growth areas. Pending the customary merger control approvals, the acquisition is expected to be completed in the second quarter of 2021. Once completed, INglass will be integrated with the existing polymer flow control business into the new business unit flow control solutions, which will become a pillar of growth for the division, Oerlikon said.

As vaccinations progress globally, it is expected that pent up demand will drive an increase in consumptions and consequently boost business. Assuming that the COVID-19 pandemic does not cause further major disruptions and markets continue to improve, Oerlikon expects sales of CHF 2.35 billion to CHF 2.45 billion and an operational EBITDA margin of 15.5 per cent to 16.0 per cent in 2021.

The order intake of CHF 327 million was slightly lower than in the previous year. The book-to-bill ratio is higher than 1, reflecting an increase in demand in the longer-cycle equipment business. Division sales were CHF 304 million, a decline of 6.3% year-over-year, due to a comparatively strong aerospace in Q1 2020 and the lower longer-cycle equipment business as indicated in March. The division saw sales recover in the shorter-cycle automotive, tooling and general industries markets. At constant exchange rates, division sales decreased year-over-year by 4.7 per cent to CHF 309 million. Operational EBITDA was CHF 54 million, or 17.7 per cent of sales, compared to CHF 41 million, or 12.5 per cent of sales in Q1 2020. The improvement in operating profitability is attributed to the structural components of the 2020 cost actions and a better business mix. Unadjusted first-quarter EBITDA was CHF 53 million, or 17.5 per cent of sales, compared to CHF 39 million, or 11.9 per cent of sales in the previous year. Q1 Operational EBIT was CHF 15 million, or 4.8 per cent of sales (Q1 2020: CHF -2 million, or -0.6 per cent of sales), and unadjusted EBIT was CHF 14 million, or 4.6 per cent of sales (Q1 2020: CHF -5 million, or -1.4 per cent of sales), according to Oerlikon.

The division delivered a very strong year-over-year increase due to a robust first-quarter performance and the comparison with a pandemic-impacted Q1 2020. Order intake increased significantly by 119.0 per cent to CHF 315 million, compared to CHF 144 million in 2020. Sales increased by 28.7 per cent to CHF 263 million year-over-year, driven mainly by India and China. At constant exchange rates, sales increased by 27.0 per cent to CHF 260 million. Operational EBITDA improved year-over-year to CHF 33 million, or 12.4 per cent of sales, compared to CHF 18 million, or 9.0 per cent of sales, in Q1 2020, due to improved operating leverage. Unadjusted EBITDA was CHF 33 million, or 12.4 per cent of sales (Q1 2020: CHF 18 million, 8.9 per cent). Operational EBIT was CHF 24 million, or 9.3 per cent of sales (Q1 2020: CHF 11 million, or 5.6 per cent of sales). Unadjusted EBIT was CHF 24 million, or 9.3 per cent of sales (Q1 2020: CHF 11 million, or 5.5 per cent of sales).

Fibre2Fashion News Desk (GK)